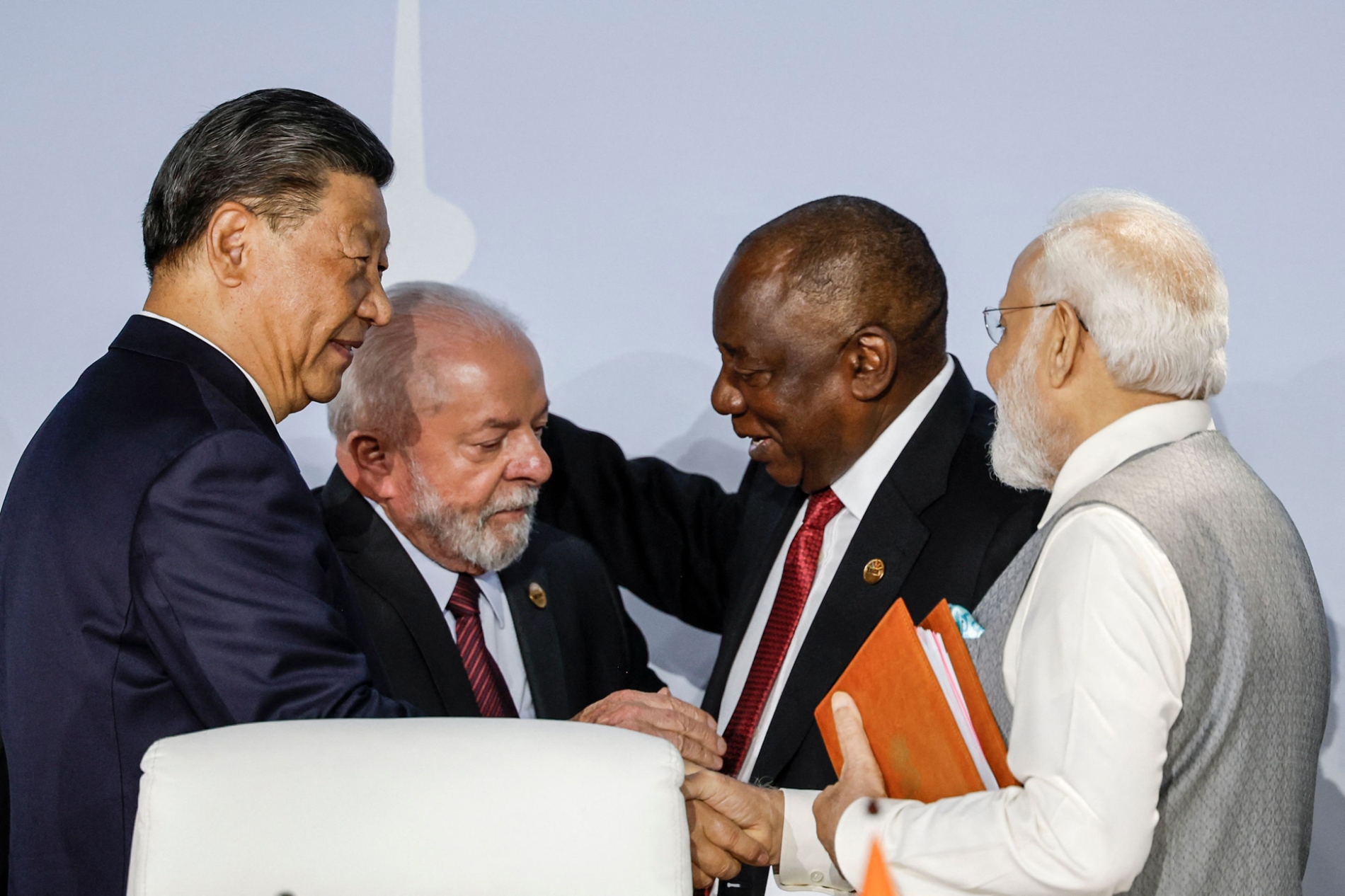

The 21st century has so far presented a complex picture of shifting fortunes, circumstances, and results. In recent years, the world has undergone profound economic, social, and political transformations that have reshaped the global balance of power and repositioned key actors, heralding a new wave of economic powers, including China, India, Saudi Arabia, Türkiye, Indonesia, and Singapore. In contrast, Western Europe’s share of the global economy has shrunk for the first time since the Industrial Revolution.

As 2025 draws to a close, the world is drifting towards a multi-layered protectionism that may affect free trade and globalisation. The contours of the new century reveal both opportunities and challenges. Entering the second quarter of the century, artificial intelligence (AI) and its necessary digital infrastructure are set to be the new global competition. According to estimates by consultants at McKinsey, up to $6.7tn could be spent building data centres.

Banks now worry about a new AI ‘bubble’ reminiscent of the mortgage crisis that caused such painful economic spasms in 2008-09, which triggered a deep global recession. The Covid-19 pandemic in 2020-21 brought world trade to a near standstill as borders closed and production lines stopped. COVID-19’s impact continues to manifest in high inflation, labour market difficulties, low growth, disrupted supply chains, and debt burdens.

Flying through turbulence

In the first 25 years of the 21st century, the world has endured numerous wars and conflicts. After Islamist terrorists attacked the United States with planes on 11 September 2001, the US invaded Afghanistan later that year. Two years later, it invaded Iraq (American forces only recently left the former and still retain a presence in the latter). In 2011, the Middle East and North Africa witnessed widespread protest movements, some of which overthrew longtime dictators and others triggered prolonged civil wars. In 2022, Russia invaded Ukraine. In 2023, Israel occupied Gaza, while Sudan began tearing itself apart.

In between, there were threats to global shipping lanes and natural disasters, which left thousands dead or displaced in countries such as Türkiye, Syria, Libya, and Morocco. Meanwhile, the effects of climate change were felt in huge wildfires in Europe and the US. Agricultural land became more precious, given the planet’s straining capacity to sustain a population of more than eight billion.

Beyond food security, there are concerns about the estimated annual loss of approximately 324 billion cubic metres of freshwater, with implications for employment, migration, and biodiversity. Despite the recommendations of the 2015 Paris Climate Conference to reduce carbon emissions and limit global warming, slow implementation and weak commitment from the world’s largest polluters suggest a period of climatic uncertainty, the risks of which may well surpass current scientific projections.

An era of prosperity

Despite all this, the first two and a half decades of the third millennium were economically prosperous, mankind benefiting from major advances in science, technology, and knowledge, while developing economies registered impressive growth. Global gross domestic product (GDP) rose from $34tn in 2000 to $114tn by 2025. Over the same period, average global per capita income rose from $5,494 to $14,210.

In industrialised nations, the average income hit $60,320, compared to $7,290 in South-East Asian countries and $6,800 in emerging and developing economies. Per capita income exceeded $141,000 in Luxembourg, $111,000 in Switzerland, $107,000 in Ireland, $94,000 in Singapore, and $90,000 in the US, according to data from the International Monetary Fund (IMF). The US Census Bureau reported that 33% of American households earned more than $150,000 in 2024, compared with 5% in 1967. At that time, the US economy was valued at $860bn. Today, it is $30.5tn.