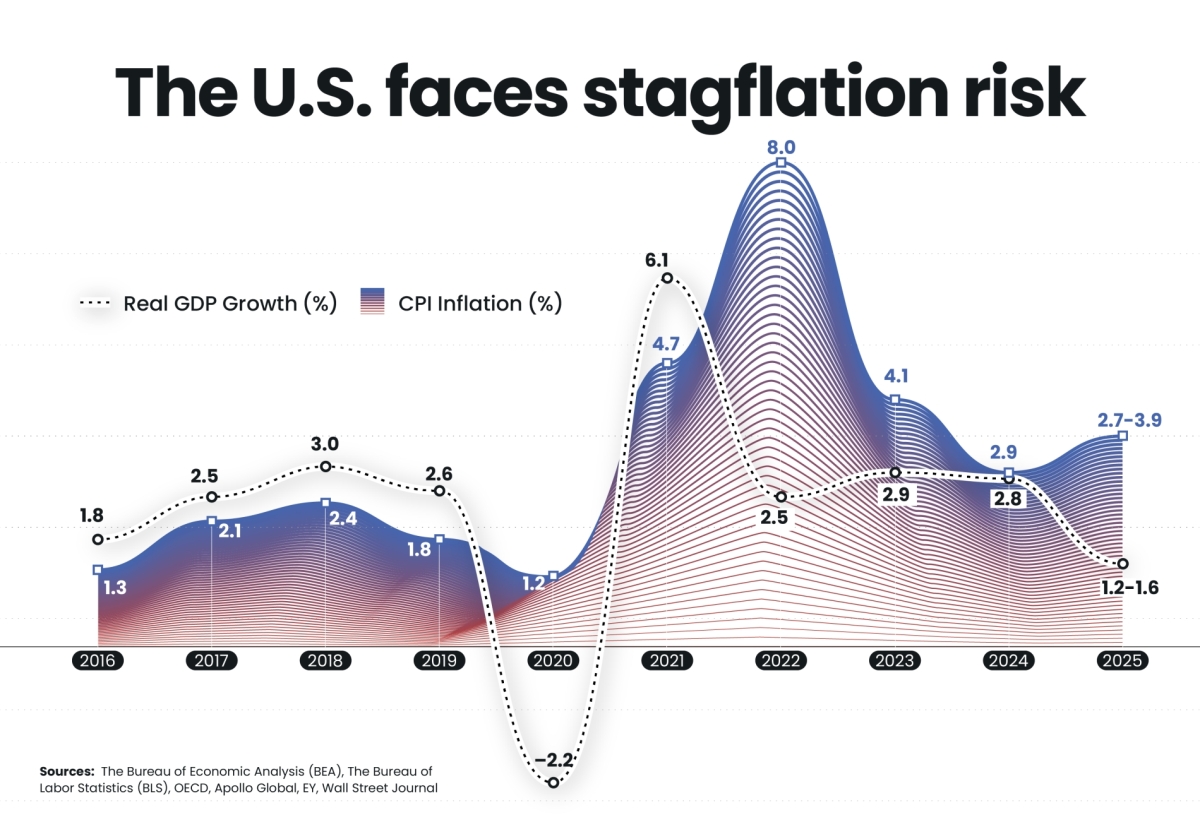

Since 2016, the US economy has experienced dramatic swings in both real GDP growth and consumer price inflation. After a period of steady expansion under President Donald Trump’s first years in office, the COVID-19 shock in 2020 triggered a sharp contraction of 2.2% in GDP, while inflation remained low, according to the Bureau of Economic Analysis (BEA) and the Bureau of Labour Statistics (BLS) statistics.

Recovery in 2021 was rapid, with GDP rebounding 6.1%, but inflation accelerated to 4.7% as supply chains strained. By 2022, the US faced the highest inflation in four decades at 8%, even as growth slowed to 2.5%. Subsequent years brought moderation—growth of about 2.8% in 2024 and inflation near 2.9%.

In 2025, however, the picture is shifting again. Forecasts from OECD, Apollo Global, and EY show GDP growth slowing to between 1.2% and 1.6%, while consumer prices are projected to rise 2.7% to nearly 4%, according to OECD. This combination of weakening growth and persistent inflation raises fears of stagflation—a toxic mix not seen since the 1970s. Contributing factors include tariffs that drive up import costs, slowing job creation, weaker consumer confidence, and sticky service-sector prices.

Policymakers face a dilemma: cutting rates risks fueling inflation, but tightening risks recession.