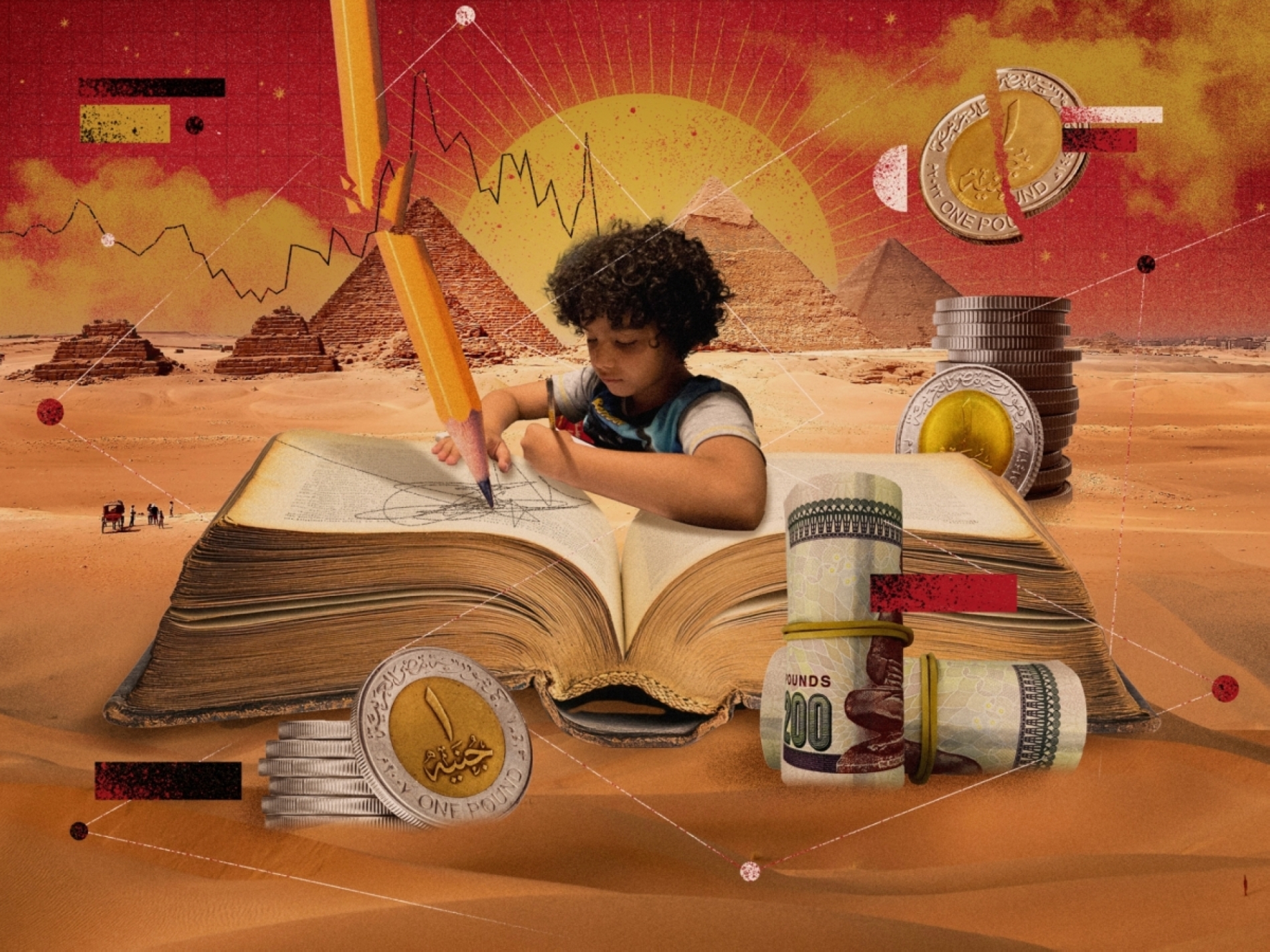

In 2025, a combination of geopolitical tension, energy market disruption, and an expected global slowdown put pressure on Egypt’s budget, debt, and investment inflows, but did not deter the state from pressing ahead with an economic course aimed at restoring monetary stability and reinforcing sustainable growth.

The most salient achievement of the past year was the clear success in containing inflation, which was 38% in September 2023 and still hovering around 27% three months ago, before a sharp fall to around 13% at the end of the year, the result of tight monetary policy pursued since March 2024.

The approach centred on raising interest rates, draining liquidity, and floating the Egyptian pound (E£), which had a positive impact on the foreign exchange market. Dollarisation receded, the pound’s rate stabilised, and the dollar went from E£51 to nearer E£47. Analysts say it amounted to a managed float designed to regain control of the market following the criminalisation of trading outside the banking system.

Trade and investment

Egypt’s trade balance recorded a marked improvement in 2025. The deficit fell by 16%, reaching $26.3bn from January to October. This improvement is attributed to more open trade policies aimed at boosting higher value exports, opening new markets, and leveraging free trade agreements, alongside a revival in tourism and remittance inflows.

In parallel, 2025 saw unprecedented momentum in acquisitions and asset sales, whether through stock exchanges or through Arab states’ sovereign wealth funds. These deals included the sale of stakes in Commercial International Bank, e-payments and digital finance firm Fawry, and major fertiliser producers such as MOPCO and Abu Qir, in addition to the Eastern Company, a large tobacco firm.

Egypt’s state ownership policy aims to reduce the government’s grip on the economy and make room for the private sector. As a result of this state loosening, Saudi, Emirati, and Qatari companies and funds have been acquisitive, indicating a growing confidence in the Egyptian market. These transactions also supported foreign currency reserves, particularly through the conversion of part of the debt into direct investment.

They nevertheless conveyed the impression of an asset fire sale, prompting public concern that the state was selling the family silver. This debate was most clearly evident in the case of the Egyptian Iron and Steel Company, where the state reversed a planned sale under public pressure, opting instead to upgrade the plant rather than liquidate it. This demonstrated the need to balance fiscal reform with the preservation of well-known symbols of national industry.