A full-blown war between Israel and Hezbollah could mark the third global catastrophe in less than five years following the pandemic and Russia’s invasion of Ukraine, two back-to-back crises whose adverse economic effects are still lingering. Soon after Israel launched a ruthless military campaign in Gaza in retaliation for Hamas’s surprise attacks that resulted in the killing of 1,200 Israelis last October, the Lebanon-based Hezbollah pledged support for its fellow Iran-backed Islamist group.

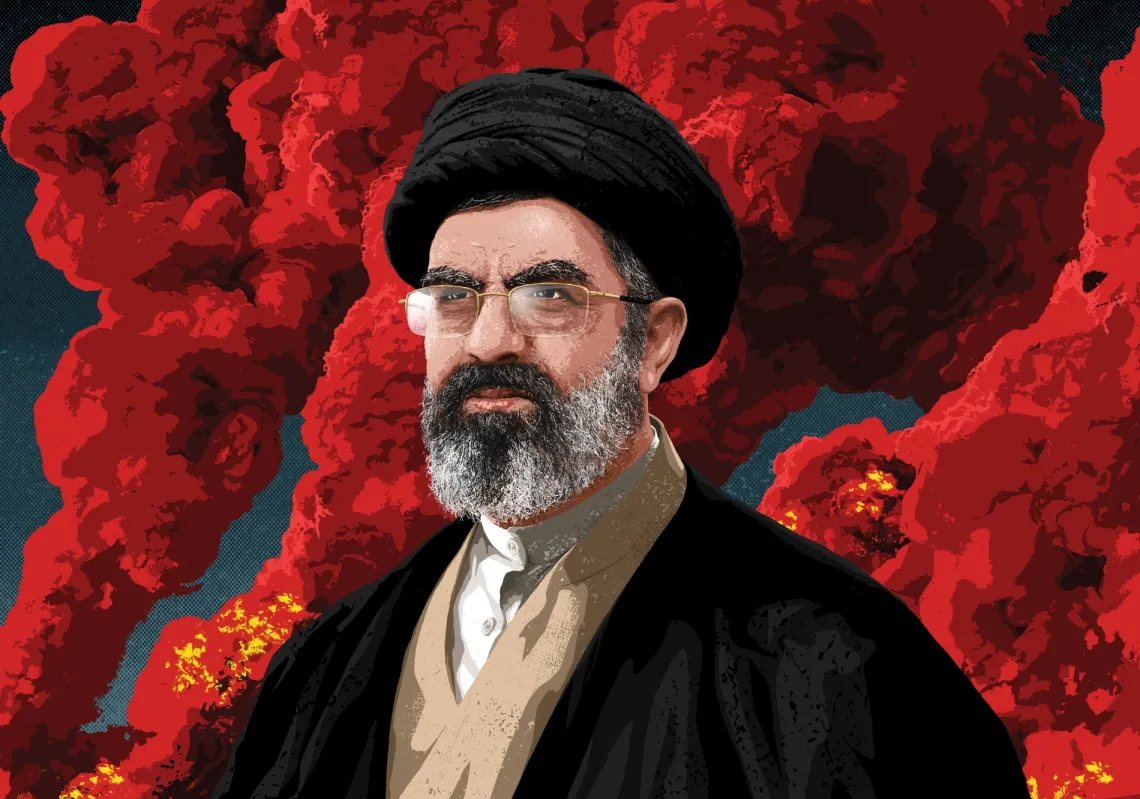

Hezbollah has since been attacking Israeli targets near the border almost daily. The Middle East’s strongest militia has upped the ante in recent months, increasingly threatening the northern part of Israel, which has, in turn, intensified its offensive on southern Lebanese territories.

Either side of the borderline has largely been uninhabited as a result of the tit-for-tat and a potentially devastating escalation. Multiple countries, including the US and Saudi Arabia, have warned their citizens off remaining in Lebanon out of fear of an upsurge in the ongoing fighting, and airlines have cancelled their flights to the beleaguered country in July.

“One rash move, one miscalculation could trigger a catastrophe that goes far beyond the border and, frankly, beyond imagination,” United Nations Secretary-General Antonio Guterres said while speaking to reporters in June.

“Let’s be clear: The people of the region and the people of the world cannot afford Lebanon to become another Gaza,” Guterres added, reflecting widespread sentiments.

No winners

Both Israel and Hezbollah will stand to lose a lot if they ignite a war between each other, with no possible rewards for either side. On the one hand, Israel has already been burdened financially by its war against Hamas, which has thus far claimed over 37,000 Palestinian lives and flattened the Gaza Strip. An adjacent war with Hezbollah could see the country’s economy shrink this year by 1.5% compared with a forecasted growth rate of 1.9%, according to the Israeli finance ministry.

On the other hand, Hezbollah, capable as it is, would likely suffer hefty losses in an all-out war against the Israeli army, both militarily and financially. Already languishing with a collapsed currency following its first-ever Eurobond default in 2020, Lebanon has been grappling with a failing economy and worsening living conditions amid a chronic political void. Millions in the cash-strapped nation could face hunger should the Shiite group and Israel lock horns, aid groups warn.

Incendiary remarks by Israeli officials have recurrently echoed, including a threat from Israeli Defence Minister Yoav Gallant to “plunge Lebanon completely into the dark and take apart Hezbollah’s power in days”. The country has long suffered from a power crisis, with its electricity grid in disrepair for decades.

If any of these grim scenarios materialise, Hezbollah—whose popularity in Lebanon has waned despite offering different forms of support for the Lebanese—will certainly be in a bind. The expected cost of the war between Israel and Hezbollah is hoped to act as a deterrent, along with international pressure and efforts spearheaded by the US and France to defuse the situation.

But on the ground, Hezbollah’s attacks have been on the rise, vowing not to stop until an agreement over a ceasefire in Gaza is in place, which numerous rounds of talks have failed to achieve. Israel, meanwhile, is anticipated to deploy more troops near its northern border to gear up for a full-fledged war.

Read more: Israel's targeted killings unlikely to push Hezbollah behind Litani

Game changer

The spillovers of Israel’s war on Gaza and its coinciding skirmishes with other militant groups in the region have not greatly rattled the global economy. However, there are reasons to believe a war between the Israeli army and Hezbollah will send shockwaves on a wider scale.

To begin with, Hezbollah’s military capabilities are significantly stronger than those of Hamas, as the group has been receiving the lion’s share of Iran’s external support and funding. And a war between Hezbollah and Israel could well be a prelude to a much-feared direct confrontation between the latter and Iran, and from there, nothing but bleak possibilities would be on the table.

“I do think that the Israel-Lebanon war is much more dangerous overall and presents much bigger upside risks than the ongoing warfare in Gaza,” Viktor Katona, Lead Crude Analyst at Kpler, told Al Majalla.

“Primarily because any conflagration with Lebanon would almost certainly involve a much more robust Iranian involvement, and from then onwards, anything could happen.”

Iran’s first-ever direct attack on Israel came in April after Israel bombed the Iranian consular building in Syria. The missile strike, which Tehran announced in advance and resulted in minimal damage, was largely seen as symbolic. Yet, it has deepened concerns over a full-scale confrontation between Israel and Iran.

Read more: Shadow war no more: How will the new Iran-Israel power dynamic affect the region?

Suez woes

Yemen’s Houthis—another key Iranian proxy in the Middle East—began to launch drone and missile attacks on merchant vessels related in any way to Israel in response to the Gaza war. This has disrupted navigation in the Red and Arabian seas as well as the Indian Ocean, which has significantly decreased traffic in Egypt’s Suez Canal and taken a toll on global trade.

In tandem with the heightened tensions between Israel and Hezbollah, the Houthis have upped the ante by executing more frequent attacks, some in coordination with Iraqi militants from the so-called 'axis of resistance'. Last month, the Houthis sank a vessel in the Red Sea, the second ship sunk by the Yemeni militant group since it started its attacks. For their part, joint US-UK military operations have largely failed to curb these attacks.

The Houthis have turned up the heat not only on Israel but also on Egypt, with the Suez Canal’s revenue—which stood at around $9.4bn in the 2022/23 fiscal year ending 30 June—slashed by more than half this year. A war between Hezbollah and Israel could further exacerbate the problems of the vital waterway, where 12% of global trade normally passes through.

“The Eastern Mediterranean could become militarised the same way that the Red Sea has been, putting a final nail in the coffin of the Suez Canal's hopes to operate normally,” Katona said.

“Once the Israel-Gaza conflict, the Houthis' retaliation strikes are over, the world will need to come back to using the Suez Canal,” he added. “Even though connecting Asia to Europe via the Cape of Good Hope is infinitely safer right now, it is also a trip that is 12-14 days longer. This means more pressure on the fleet, higher costs for shipping in general and higher bunker fuel consumption across the board.

“If sellers and buyers of this universe could cut their costs, they would do that in an instant. However, for the time being that doesn't look like a realistic scenario, at best we're going to see a normalisation in shipping only from 2025 onwards. And even that's questionable.”

A global relapse?

The Ukraine war—which erupted in February 2022—saw oil and commodity prices soar due to logistics challenges, triggering a wave of interest rate hikes by key economies to tame inflation. Emerging markets, as such, followed suit.

Multiple governments have recently started to loosen their monetary policies after inflationary pressures gradually cooled off: Brent prices rocketed to $140/b in 2022 and are currently averaging at $85. The US Federal Reserve and European Central Bank are foreseen to cut their rates by next September, which would draw more economies towards the easing cycle.