American eyes are closing in on Lebanon’s economic and monetary systems, amid suggestions that Hezbollah is laundering money through the country. At its core, Washington is concerned that the group is transferring funds in ways that let it bypass restrictions and international monitoring mechanisms.

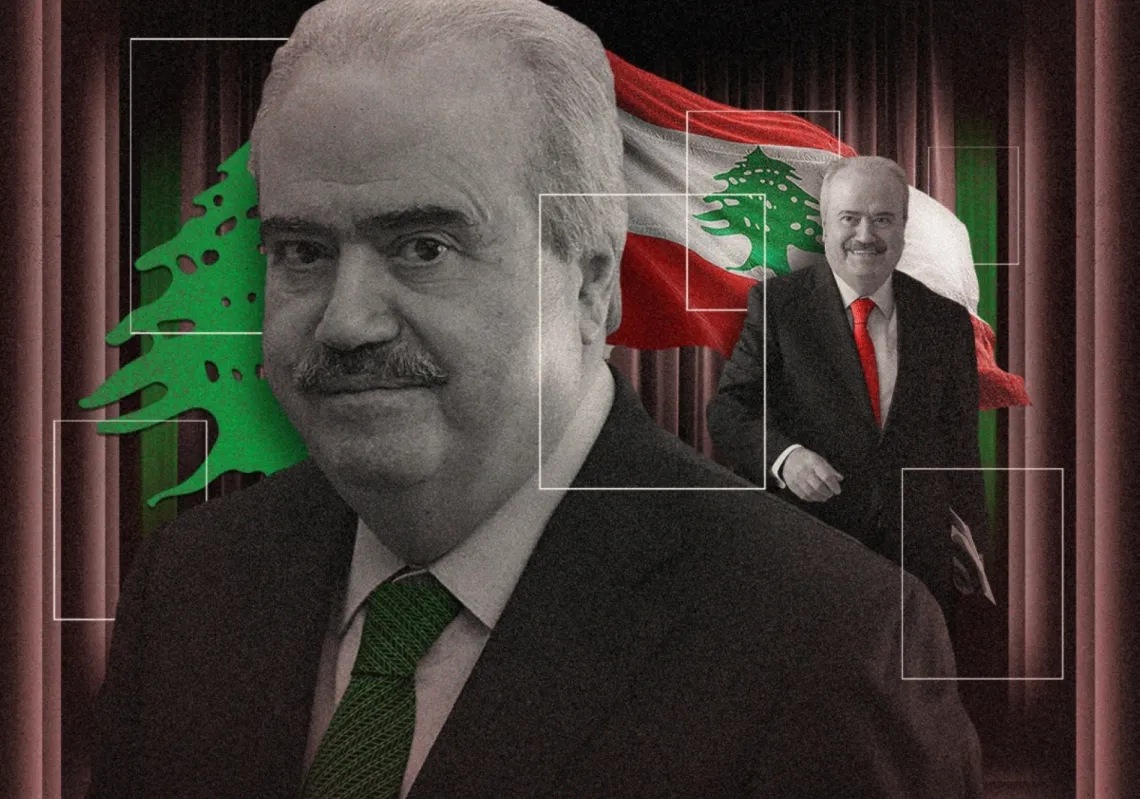

This was at the top of the agenda when a high-level US delegation visited Beirut earlier this month. National Security Council counter-terrorism chief Sebastian Gorka, Under-Secretary of the Treasury John Hurley, and counterterrorism expert Rudolph Atallah were among the senior US officials to fly in. Atallah is a former US Air Force colonel of Lebanese descent.

Speaking to Reuters from Istanbul beforehand, Hurley described a “window of opportunity” for the US to sever Iran’s financial lifeline to Hezbollah and compel the group to disarm. He disclosed that Iran had managed to transfer “nearly $1bn” to Hezbollah in 2025, despite a raft of sanctions that have crippled its economy.

No more games

Hurley’s regional tour of the UAE, Türkiye, Lebanon, and Israel aims to galvanise efforts to dismantle Iranian influence, particularly through Hezbollah and its affiliated networks. While Washington continues to monitor terrorist financing and the movement of funds, Hurley’s mission is to coordinate regional efforts to sever the funds flowing to Tehran and its proxies. In this context, Hezbollah wants to sustain Lebanon’s “cash economy,” which operates outside formal banking oversight.

Diplomatic sources told Al Majalla that the American delegation stressed the importance of disarming Hezbollah in parallel with financial reforms. There was dissatisfaction with Lebanon’s handling of the Hezbollah-linked non-profit financial institution Al-Qard Al-Hassan, which provides interest-free loans. The sources warned that continued inaction could mean that Lebanon soon faces severe consequences.

Allegations that Hezbollah has used money transfer companies to channel funds to its charities and support base raise serious questions. It also invites intensified scrutiny of these firms, with the prospect of sanctions if evidence emerges. Those facilitating these transfers are not currently believed to be under international sanctions or to have documented links to financial crimes.

Although there is parallel pressure for the group’s weapons to be placed under state authority, Washington’s targeting of Hezbollah is now honing in on its financial infrastructure, which sustains its capabilities and support network. Yet from bypassing sanctions on Al-Qard Al-Hassan to using money transfer companies in concealed ways, Hezbollah has shown its ability to adapt.

Digital money transfers

On 2 November, the Financial Times reported that Hezbollah had instructed its affiliated charities to solicit donations through digital money transfer platforms to circumvent US sanctions. This led The Wall Street Journal and others to urge tighter financial oversight, both within Lebanon and at its borders. According to the Financial Times report, charities sanctioned for links to Hezbollah have begun using Lebanese digital payment platforms to solicit donations.

Posters and websites affiliated with organisations such as the Martyrs Foundation and Al-Imdad Association have urged supporters to transfer funds via Whish Money, OMT, or through digital wallets registered under individual names. By donating via personal wallets rather than organisational accounts, contributors can evade automated compliance systems designed to flag suspicious financial activity.

The newspaper cited a case in which a donation from the Democratic Republic of Congo was reportedly channelled through Ria—a global partner of Whish—before being deposited into a digital wallet in Lebanon registered to an individual linked to a blacklisted charity. In response, representatives from Whish and OMT told the Financial Times that they maintain rigorous anti-money laundering protocols and denied any knowledge of processing transactions for sanctioned entities.

Lebanon’s central bank, Banque du Liban, acknowledged growing international concerns and said it had instructed all licensed money transfer firms to reinforce their compliance and monitoring systems. It added that financial regulators had not received evidence implicating OMT or Whish in any wrongdoing. Still, a Lebanese official confirmed that the rapid expansion of digital wallets was a new regulatory challenge, particularly amid Lebanon’s ongoing financial crisis.