"We will act to take Russian oil and gas off the global market," said UK Prime Minister Keir Starmer during a press event in London on 25 October. Flanking him were Ukrainian President Volodymyr Zelensky, NATO General Secretary Mark Rutte, and the leaders of Denmark and the Netherlands.

This meeting of the 'Coalition of the Willing', which included other European leaders who joined via video link, took decisive new steps against Russia, emboldened by fresh US sanctions announced earlier in the week.

But what has been agreed, and how much pressure will this put on the Kremlin?

Trump steps up

Donald Trump has been president of the US for nine months, but this is the first time his administration has confirmed new sanctions against Russia. Until now, his policy has been to engage with Vladimir Putin and bring him to the negotiating table, culminating in a face-to-face meeting between the two leaders in mid-August—something most analysts considered unthinkable during Joe Biden's presidency.

Trump had even suggested they would meet again soon, with Budapest slated as the likely host country. However, there are signs that the US president is tiring of the Kremlin's failure to move towards peace—or at least a ceasefire.

"Every time I speak with Vladimir, I have good conversations, and then they don't go anywhere. They just don't go anywhere," said Trump on 22 October.

Trump: Every time I speak to Vladimir (Putin), I have a good conversation... and then they don’t go anywhere. They just don’t go anywhere. pic.twitter.com/8HsSK7WcJv

— Polymarket Intel (@PolymarketIntel) October 23, 2025

Oil firms targeted

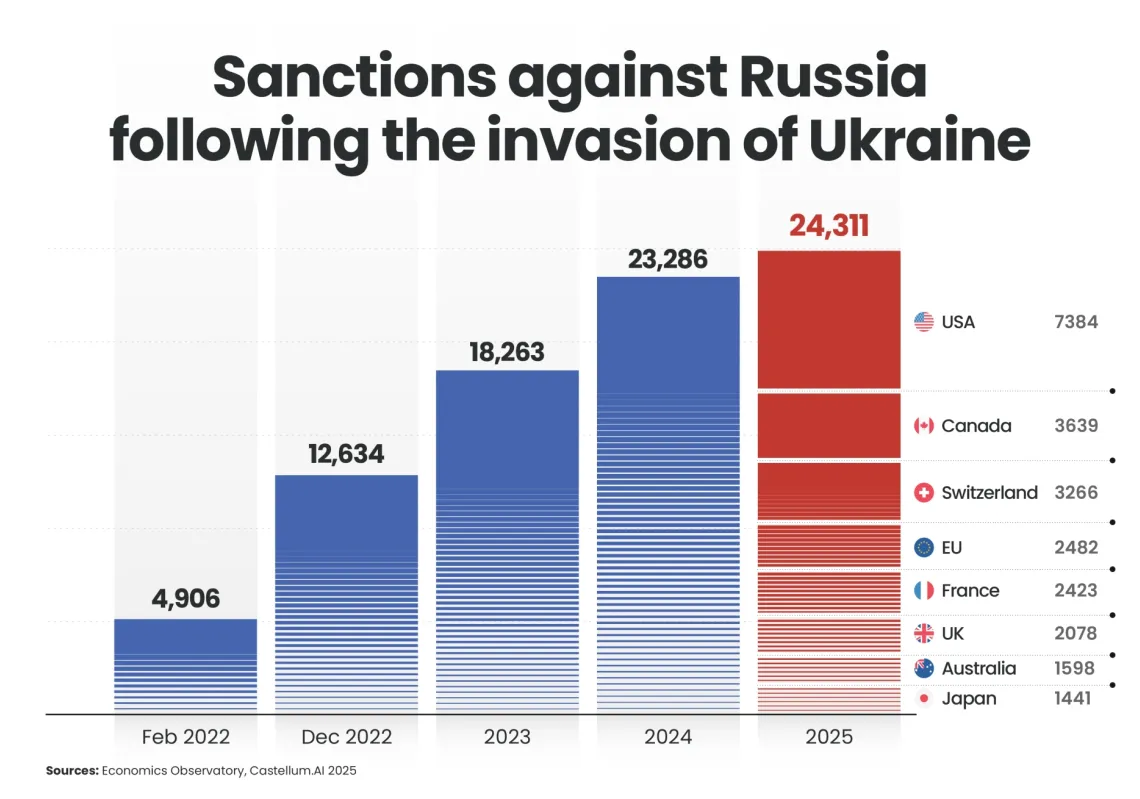

The US sanctions target Russia's two largest oil companies, Lukoil and Rosneft, blocking their assets in the US and prohibiting American companies from doing business with them. For its part, the European Union (EU) adopted its 19th package of sanctions against Russia on 23 October. In addition to a full transaction ban on Rosneft and Gazprom Neft, these sanctions target Russia's exports of liquefied natural gas (LNG) for the first time.

This move follows years of debate. Since the launch of Russia's full-scale invasion of Ukraine in February 2022, the EU has continued to buy Russian LNG, paying an estimated €73bn by some estimates. However, the import ban will only come into effect on 1 January 2027, giving EU member states time to transition to alternative suppliers. The new EU package also targets Russia's shadow oil fleet. An additional 117 vessels were listed, bringing the total number of banned ships to 557, thereby denying them access to ports and services. Moreover, the sanctions targeted companies that serve this fleet, including Litasco Middle East DMCC and two oil trading companies based in Hong Kong and the UAE.

The biggest buyers of Russian oil—India and China—were not targeted in the latest round of White House sanctions, despite constant hints from Trump that he wants to see a change of tack from New Delhi and Beijing.

The president has stated several times in the past few weeks that Indian Prime Minister Narendra Modi has agreed to stop buying Russian oil—a claim denied by New Delhi. Trump also suggested he might raise the topic with Chinese President Xi Jinping during their meeting in South Korea at the end of October, the first time the two have met during Trump's second term.