When US Secretary of State Hillary Clinton traveled to the Persian Gulf in February, high on her list of priorities was gaining support for a new round of sanctions against Iran’s nuclear program, which Washington and others suspect is geared towards weapon development. Clinton focused much of her attention on the Iranian Revolutionary Guard Corps, the paramilitary organization with extensive political, military, and economic power in Iran and the region. Warning that that Guard’s rising influence was moving Iran “towards a military dictatorship,” Clinton called for expanded sanctions against individuals, banks, and companies doing business with the Iran. Less noticed was a subtle message she delivered to an audience sitting more than 6,500 kilometers away in China.

In more than four hours of private talks at King Abdullah’s desert camp outside of Riyadh, Clinton is reported to have nudged Saudi Arabia to use its growing influence with China to help persuade it to back new sanctions against Iran. Key to that message would be assurances that Saudi Arabia would make up for lost oil supplies if China were to see a disruption in the more than 500 thousand barrels a day it receives from Iran. This effort to pry China out of its burgeoning relationship with Iran comes on the heels of similar offers made by the United Arab Emirates and Kuwait.

The oil-for-cooperation proposals revealed not only the centrality of energy to China’s foreign policy, but the degree to which China has emerged as a key issue in the region. Regardless of whether the oil-supply guarantees are accepted, these proposals signify a turning point in China’s steady rise over the past two decades. China is now a player in Gulf security. The question is: will China be a responsible player or will it continue to narrowly focus on its energy interests?

An Old Relationship with New Dimensions

China is of course not new to the Gulf. Long predating oil’s emergence as a geopolitical issue, China and the region have enjoyed a long trading relationship. As far back as 3,000 years, merchants, missionaries, and pilgrims traversed the ancient Silk Road routes between the Gulf and China. Over the centuries, deep commercial, cultural, and technological linkages were formed as goods were traded and knowledge and ideas were spread. Almost 1,500 years ago, the Chinese Eastern Han Dynasty established maritime linkages with the region and the Persian Sassanid Empire (which ruled much of what we refer to today as the Middle East and South Asia). The Sassanids exported carpets and other goods to China and even stationed a permanent trade mission there.

Trade between these two regions is no less important today. In 2008, trade between China and Gulf Cooperation Council (GCC) countries and Iran stood at over $100 billion, growing at an extraordinary average of 20% per annum over the past few years. While Chinese exports to the Gulf—ranging from chemicals and plastics to textiles and electronics to aviation and military equipment—have not been negligible, the mainstay of trade between the two regions has been energy exports from the Gulf, particularly oil. Three of China’s top suppliers—Saudi Arabia, Iran, and Oman—are located in the Gulf. In 2009, nearly half of Chinese oil imports came from the Gulf, with more than one-third coming from Saudi Arabia and Iran alone.

This growing relationship has not gone unnoticed. King Abdullah chose China as his first state visit after assuming the throne. Chinese President Hu Jintao has since reciprocated with two visits to Saudi Arabia, most recently in February of last year. In fact, Clinton’s trip was preceded by a visit from Chinese Foreign Minister Yang Jiechi in January. In addition to frequent Chinese visits to the region, the United Arab Emirates, Kuwait, Oman, Bahrain, Qatar, and Iraq have all sent high-level delegations to Beijing.

Trade and investment between Iran and China, in particular, has grown at a breathtaking pace over the past few years. In 2009, investment between the two countries reached an estimated $36.5 billion, up 35% from 2008 levels.

But no part of that relationship is as strategically significant as the energy-sector. According to the US Energy Information Administration, Iranian oil exports to China shot up from 425,000 barrels per day in 2008 to 544,000 in 2009, an increase of nearly 30%. Imports from Saudi Arabia, although still larger in volume, rose by only 2% over the same period, indicating that Iran is fast gaining ground. And no other Gulf country has received more Chinese energy-related investment than Iran—Chinese companies are estimated to have committed close to $120 billion to Iranian gas and oil projects, although many of these deals will take years to work out.

A Relationship Anchored in Self-Interest?

Beijing’s deepening energy relationship with Iran is driven in large part by skyrocketing demand at home. According to Platts, a leading source of energy market reporting, Chinese oil demand grew by an astonishing 6.6% from 2008 to 2009. In fact, China’s oil imports hit a historic high in December 2009, as it imported more than 5 million barrels per day. With demand expected to double by 2030, China desperately must find sufficient sources of oil to keep its economy going.

For Beijing, this is very much viewed as a national security issue. If it cannot sustain annual economic growth rates of 7-8%, the government fears its inability to address income inequality, poverty, and emerging social issues will be met with popular upheaval.

To satisfy this steep increase in demand, China has engaged in a worldwide shopping spree, drawing from its estimated $2 trillion in currency reserves to buy oil and gas supplies from around the world, often trading loans or infrastructure projects in return for guaranteed energy shipments. For example, since last summer, China has concluded a $25 billion loan to cash strapped Russia in return for 300,000 barrels of oil a day over the next two decades, a $10 billion loan to Brazil in return for 200,000 barrels of oil a day over the next 10 years, and a large joint-venture in Venezuela’s Orinoco Oil Belt. Since 1992, China has in fact made an astounding 208 oil investments overseas, 40 of which were in the Middle East.

All Eyes on the Gulf

The Persian Gulf is a particularly attractive source of energy for China. Not only are the shipping distances back home shorter than Latin America and Africa, much of the world’s remaining reserves of oil and gas are in the Gulf: over half of the world’s remaining conventional oil lies in only five Persian Gulf countries—with Saudi Arabia, Iraq, and Iran alone holding 43% of all remaining supplies. The natural gas picture is not very different. Three of the top-five reserve holders are in the Gulf, with Iran and Qatar holding the world’s second and third largest reserves, respectively.

The energy reserves in the Middle East are also not as technically challenging as some other parts of the world. Chinese national oil companies do not yet possess the advanced technology required to unlock reserves in the Arctic Ocean or offshore stakes in West Africa. Iran offers China both an opportunity to gain valuable experience, and, because many international oil companies have either boycotted or been sanctioned out of investing there, a less competitive environment.

In Whose Interest?

Tehran also views its mushrooming relationship with China in strategic terms and is eager to see China invest in its decaying petroleum sector. Years of sanctions, Iran’s confusing and unstable business climate, and a failure to reinvest profits back into the industry have resulted in steadily falling production levels. While Iran may be exporting more oil to China each year, it is actually producing less of it, potentially 10-12% less per year. The domestic refinery sector has not fared well either. Iran, after failing to expand refinery capacity when state revenues were soaring on the back of rising prices leading up to 2008, is forced to rely on imports to meet 40% of domestic demand. This dependency is quite costly on the Iranian treasury, as the state must absorb the difference between the market price it pays for the gasoline and the heavily subsidized rate it charges consumers.

Even the reliability of these imports is tenuous, now that the U.S. has stepped up a campaign to sanction gasoline suppliers. In recent months, Royal Dutch Shell, Kuwait’s IPG, and Switzerland’s Glencore halted shipments to Iran, privately citing that it was not worth jeopardizing their US business interests. Only five companies continue to sell to Iran, among them Malaysia’s Petronas and Russia’s Lukoil.

Keen to find an international partner willing to invest in its petroleum sector, Iran looks to China. Iranian officials have made no secret of this desire. “We would like to give preference to exports to China,” declared former Iranian Oil Minister Bijan Zanganeh in 2004. Ali Akbar Salehi, Iran’s former representative to the International Atomic Energy Agency, speaking about China, supported this view: “We mutually complement each other. They have industry and we have energy resources.”

But in Tehran’s eyes, the strategic value of the relationship goes far beyond the mutually beneficial development of energy, and perhaps even beyond that which China contemplates. If Iran can make itself attractive enough as an energy source for China, which wields a UN Security Council veto, it will have recruited a powerful supporter in the confrontation over its nuclear program with the US and many of its neighbors in the Gulf. If China became so heavily dependent on Iran’s petroleum sector, the thinking goes, it would be reluctant to jeopardize supplies with new sanctions, even if Iran should construct a nuclear weapon. Iranian President Mahmoud Ahmadinejad betrayed Tehran’s desire to rope China into its geopolitical battles: “The common enemies of the two nations are against [the] progress and development of both Tehran and Beijing.”

Friend or Freeloader?

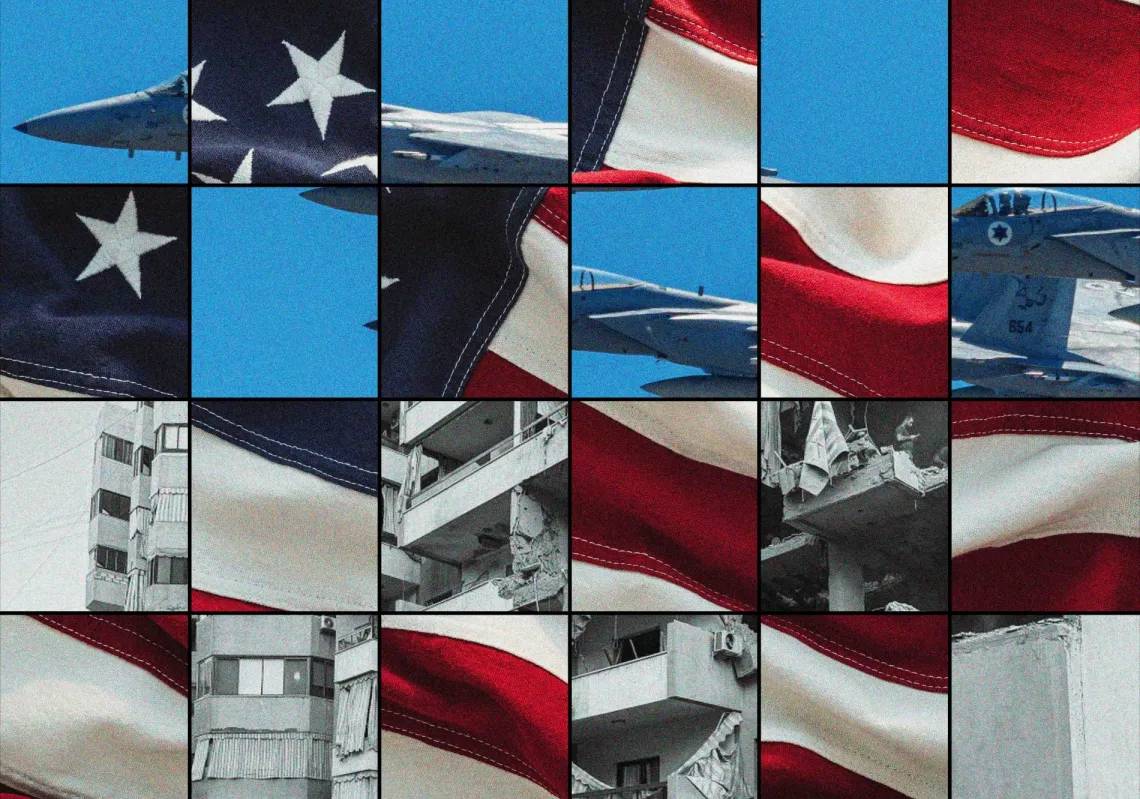

Others are starting to take Beijing and Tehran’s deepening relationship seriously. Not only do the United States and many in Europe now view China’s involvement in the Iranian energy sector as an impediment to resolving the nuclear issue, officials in the United States have gone so far as to offer evidence that Chinese companies have been evading the UN ban on selling dual-use military technology and materials to Iran. The UAE has also come forward to report that it had intercepted two shipments from China bound for Iran containing aluminum and titanium sheets, which can be used in missile production.

And by linking China’s energy interests in Iran with progress on the nuclear program, Secretary Clinton is attempting to put the onus on Beijing to make the next move in the Gulf. Will it recognize, as she said, “the destabilizing impact that a nuclear-armed Iran would have in the Gulf, from which they receive a significant percentage of their oil” or will it continue to myopically chase after Iran’s energy riches without abandon?

If it chooses the latter, it will ironically have the effect of jeopardizing its own energy security. An Iranian nuclear weapon would undoubtedly increase tensions in the Gulf as other countries move to counterbalance Iran’s newly acquired weapons capability. This would directly affect China, as roughly half of China’s imports—and 40% of the world’s seaborne traded oil—pass right through the Strait of Hormuz daily. Wedged between Iran and Oman and only 34 kilometers wide at its narrowest point, shipments from the oil producing regions of Saudi Arabia, Iran, and the United Arab Emirates, along with major producers Kuwait and Iraq, must pass through this maritime chokepoint. Iran has already threatened to shut down the strait in response to an attack on its territory, which unfortunately becomes more likely as tensions rise over its clandestine nuclear program.

With Power Comes Responsibility

While it is clear that China has arrived as a player in the Gulf, it is not clear how Beijing will see its responsibility to contribute to Gulf security. Will Beijing choose to trust that its GCC partners will ensure that its oil demand is met or will it embrace Iran, a partner that appears to have aspirations for a relationship far beyond what Beijing has in mind?

The GCC should also use this as an opportunity to evaluate its relationship with China. If Beijing accepts the supply assurances, it will signal that China is serious about becoming a partner in Gulf security. If it chooses to plow ahead with its narrow interests in Iran—even if doing so ultimately compromises its own energy security—the GCC should consider whether China is little more than a mercantilist fixated on the region’s oil.

Daniel Freifeld is director of international programs at New York University’s Center on Law and Security