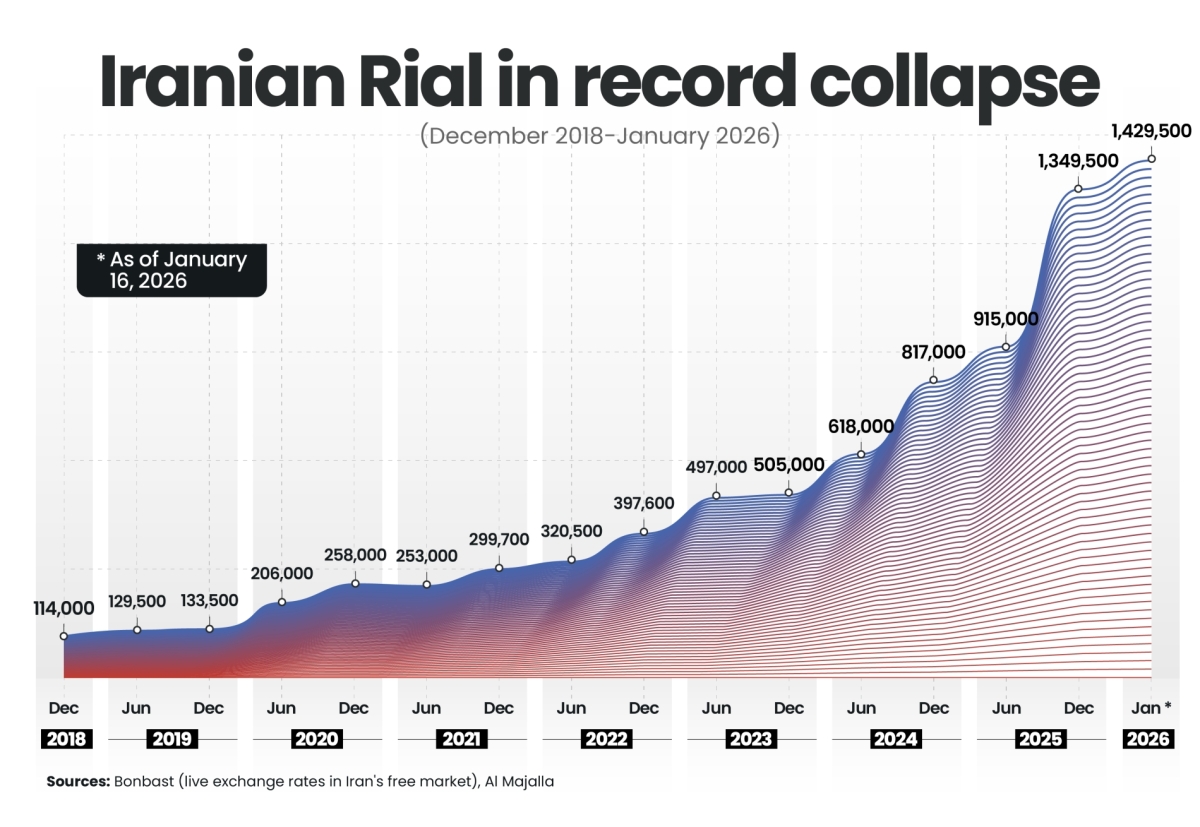

In late 2025, the Iranian rial fell to historic lows, reaching around 1.42–1.47mn rials per US dollar on the free market, according to Bonbast. This reflects deep economic vulnerabilities: high inflation, fiscal deficits, weak non-oil growth, and restricted access to foreign currency due to sanctions. Annual inflation exceeded 42%, pushing essential goods far beyond the reach of wages.

The rial’s collapse has been a focal point of nationwide protests, starting with bazaar strikes in Tehran and spreading to cities such as Isfahan, Shiraz, and Mashhad. Protesters cited soaring prices, shrinking purchasing power, and financial mismanagement, while some demonstrations evolved into broader political demands. Analysts note these are among the largest protests since the 2022 “Women, Life, Freedom” movement.

A key trigger was the collapse of Ayandeh Bank—one of Iran’s largest private banks, linked to politically connected elites. The bank amassed billions in bad loans for speculative projects, and its failure forced the Central Bank to inject large amounts of liquidity, further weakening the rial and fueling inflation. This scandal highlighted elite misconduct and reinforced the perception that Iran’s economy is rigged against citizens.

While Iran's government blamed external forces for orchestrating the sudden drop to stoke domestic tensions, it also took steps aimed at addressing Iranian grievances. The Central Bank Governor stepped down amid renewed government pledges to stabilise the currency.

This requires credible reforms and disciplined fiscal policy. But with crippling Western-imposed sanctions, currency stabilisation isn't easy. Without lifting them, inflation and currency weakness are likely to continue, risking further unrest.