Emerging markets had a bumpy 2018. Over the summer, Argentina and Turkey saw their currencies fall sharply as their economies ran into trouble. Argentina had to turn to the International Monetary Fund for a $57 billion loan. Commentators sharpened their pencils, ready to draw parallels with the wave of financial crises that swept over emerging markets in the late 1990s.

Yet most emerging-market economies came through the summer’s turbulence more or less unscathed. That is largely thanks to big improvements in economic and financial management since the last major wave of crises in the 1990s. Most countries that succumbed to crises then have moved from pegged exchange rates to largely floating exchange rates and have adopted sounder monetary policies. Most also now have more resilient banking systems, the result of a general shift away from risky short-term bank funding in favor of long-term funding from bond markets.

Perhaps the most remarkable change since the crises of the 1990s has come in the way emerging-market countries finance their debt. Governments now borrow much more in their own currencies than in foreign ones, making them less vulnerable to runs and currency crises. But risks remain. Developing countries still have work to do if they are to shield themselves from the vicissitudes of global financial conditions.

ORIGINAL SIN

Economists once thought that emerging-market countries that borrow from abroad were confined to doing so only in foreign currencies. Barry Eichengreen and Ricardo Hausmann called the phenomenon “original sin” because it seemed to doom developing countries to perpetual dependence on foreign financial conditions. When a country’s currency fell, its government found its debts harder to pay. Debt crises turned into currency crises.

But since the 1990s, the share of emerging-market government debt issued in foreign currencies has fallen significantly. Foreign investors have grown more comfortable owning government debt denominated in the local currency. In some countries, such as Peru, South Africa, and Indonesia, foreign investors now hold around 40 percent of government debt in the local currency. Many other large emerging-market economies have figures close to this level. Companies in these countries still rely on foreign currency borrowing, but for their governments, original sin has turned out to be less a fundamental weakness than a passing phase.

Governments have gained greater control over their finances by developing local bond markets, shifting their economies away from relying on the kinds of short-term loans in foreign currency that left them vulnerable in the 1990s. But for all the good these changes have done, emerging-market countries have discovered that borrowing in their own currencies does not solve all financial woes. They are still vulnerable to the ebb and flow of global financial conditions.

To see why, look at the effects of exchange-rate changes on domestic inflation. If global financial conditions worsen and capital starts flowing out of an economy, the domestic currency falls. When that happens, inflation tends to rise, since imports get more expensive. If investors trust the central bank to keep inflation under control, the bank can raise rates to bring the economy back to an even keel. But expectations become self-fulfilling: if investors don’t trust the central bank, raising rates by itself won’t do the trick, and drastically tightening monetary policy will further damage an already weak domestic economy. If the political fallout is serious enough, policymakers may lose their nerve and reverse course.

It’s worth taking a step back, however, and asking why a big fall in the domestic currency causes problems at all. After all, economics textbooks teach that when a currency falls, it gives the economy a boost by making exports more competitive. A stronger economy, the argument goes, then starts a virtuous circle and restores the confidence of global investors.

But although this effect is undoubtedly important over the medium term, it does not always seem to hold in the short term. That's largely because of the pressure currency depreciations put on global investors. Those investors measure their returns in terms of dollars or other major currencies (such as euros or yen), so exchange-rate moves amplify their gains and losses. A sharp fall in a currency can push investors to sell even more of their assets before the boost to exports turns the economy around and attracts new investment.

Bonds are riskier for global investors than local investors, as we can see by a measure of riskiness known as a bond’s “duration.” The duration of a bond reflects the degree to which the percentage return on the bond depends on changes in interest rates. In general, when bond prices fall, interest rates rise, since the fixed payments to bondholders make up a larger percentage of the bond price. The reverse also holds: when interest rates fall, existing bonds rise in value. The higher the duration, the bigger this effect—that is, the more the bond’s returns will move when interest rates change, and thus the riskier the bond is for investors.

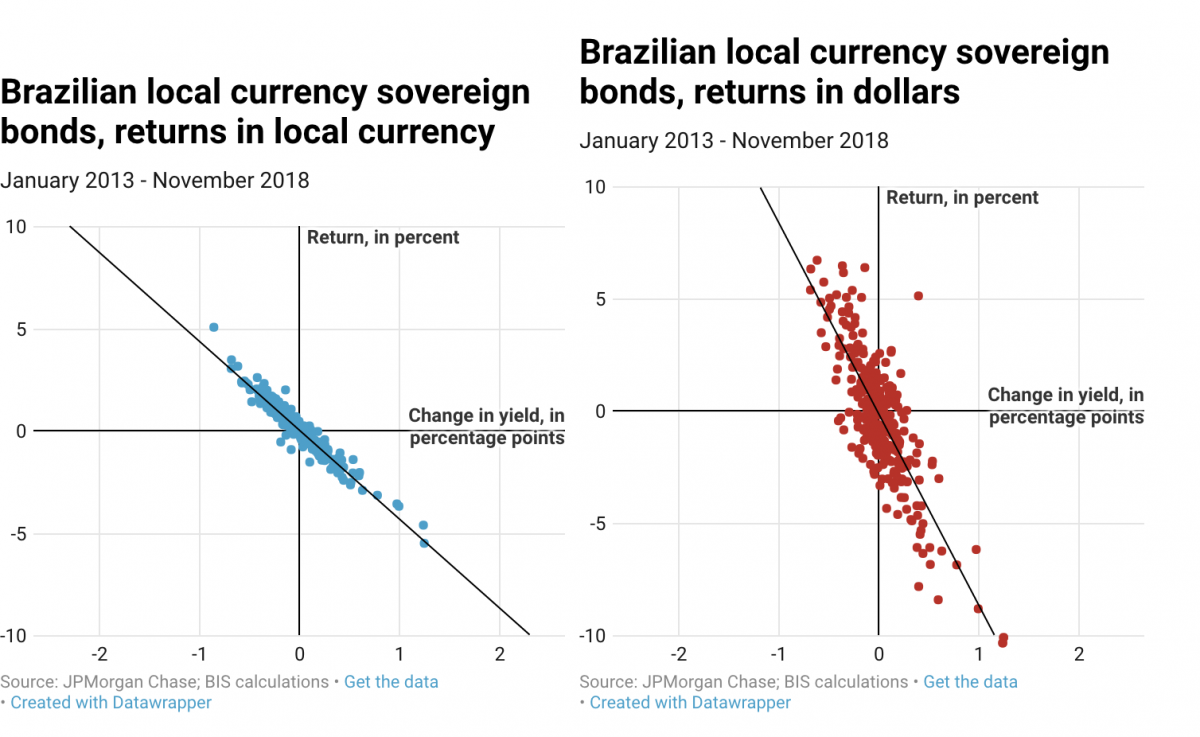

Crucially, bond returns—and thus duration—can be expressed in terms of the local currency and in dollar terms. For many emerging-market countries, local currency sovereign bonds have significantly higher durations in dollar terms than in local currency terms. The graphs below show the weekly returns to investors from Brazilian sovereign bonds denominated in local currency, with returns in the local currency (on the left) and in dollars (on the right).

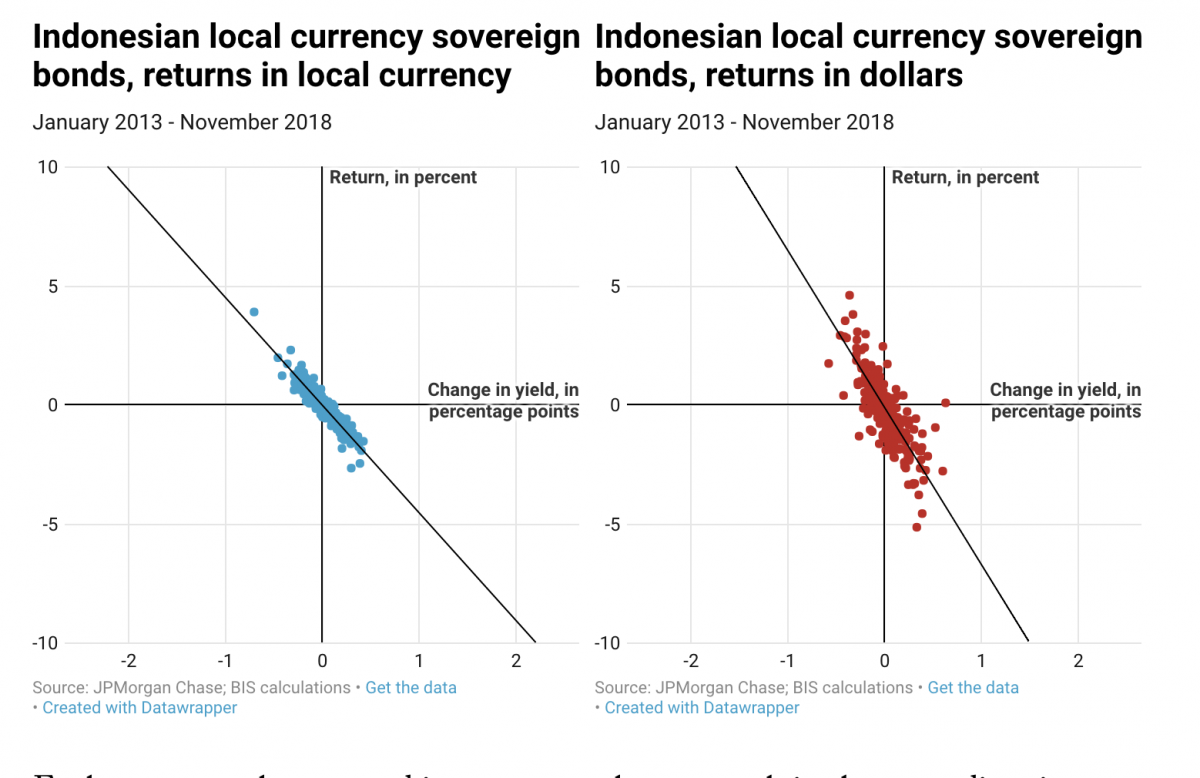

The slope of the lines shows the percentage return on the bond to a one-percentage-point change in the yield—that is, the duration. The important point is that the slope of the red line (which gives the duration in dollar terms) is steeper than the slope of the blue line (which gives the duration in local currency terms). For Brazil, the dollar duration is 8.5 and the local currency duration is 4.3. The same pattern holds in Indonesia, as shown in the graphs below, where the dollar duration is 6.6 and the currency duration is 4.5. For global investors, who care about returns in dollar terms even when they buy bonds in the local currency, these bonds are riskier than they are for local investors, who care only about returns in their own currency.

Exchange-rate changes and interest-rate changes push in the same direction. When yields rise, financial conditions tend to be tighter, so demand for the local currency falls and the currency depreciates against the dollar (at least in the short term). So dollar-based investors lose twice: because they must convert the local currency back to dollars at the lower rate and because the local currency price of the bond will have fallen in response to the rise in interest rates. The reverse is also true. When yields fall and bond prices rise, financial conditions are generally looser and investor flows push up the value of the local currency, such that dollar-based investors gain from both the price rise and the more favorable exchange rate. In that case, confidence that the authorities have things under control will limits the sales of bonds, cushioning the joint movement of bond yields and currency movements. This broad pattern holds for emerging markets as a group.

Think of this effect like a wind-chill factor that dollar-based investors experience but local investors don’t. Global investors have to deal with the effect of currency movements (the wind chill) on top of the underlying local currency returns (the temperature). For this reason, bonds in emerging-market countries tend to be riskier for global investors, who care about returns in dollar terms than they are for local investors, who care about returns only in their own currency. So dollar-based investors stand to gain and lose much more. Emerging-market governments, it turns out, are still vulnerable to ups and downs in global markets even when they borrow in their own currency.

ORIGINAL SIN REDUX?

Original sin, then, may not have been vanquished after all. It may merely have shifted from borrowers to lenders. To illustrate the point, it helps to consider how global investors make their decisions. Major investors, such as pension funds and life insurance companies, have obligations to their beneficiaries and policyholders in their home currencies—dollars, euros, or yen. Many such investing giants put limits on how much risk their investment managers can take—limits denominated in their home currency. Investors may also be swayed by advice from consultants to give more emphasis to recent news.

Such risk aversion can cause problems. These investors hold assets in a wide range of currencies, including local currency sovereign bonds from emerging-market economies. But although their assets are spread over many currencies, they incur liabilities in only one, their home currency. When emerging-market bonds fall in value, the effect is amplified by the associated currency depreciation, which can trigger global investors’ risk limits, leading them to sell their assets. That in turn puts further downward pressure on the borrower’s local currency. If the currency and bond prices both fall far enough, they can set off even more selling by investors.

If that’s the case, then, emerging markets still suffer from original sin, although not in the way Eichengreen and Hausmann originally theorized. Borrowers used to contend with a currency mismatch, as they would take in revenues in the local currency but owe debts in foreign ones. Now, the currency mismatch problem may have moved to the investors, who lend in one currency but must pay their beneficiaries and policyholders in another.

Given this shift, financial analysts should pay more attention to lenders. Commentators tend to focus on the borrowers—their latest current account deficit numbers and budget projections, the twists and turns in their politics—and pay much less attention to what drives the supply of credit. But lenders’ actions matter, too.

THE ROAD AHEAD

How should emerging-market governments deal with the new original sin? One way would be to develop a large domestic institutional investor base that sets its objectives in domestic currency terms and is thus insulated from exchange-rate swings. National pension systems contribute to this goal, and many emerging-market countries, such as Chile and Mexico, have made solid progress in this direction.

But this prescription relies on countries already having large domestic pools of wealth. Some emerging-market countries fit this bill, particularly if they have experienced rapid economic growth and demographic changes, such as an aging population, that increase savings rates. But many developing countries can’t provide such large pools of investors to buy their government debt, at least not in the short run.

They can, however, deepen their domestic capital markets over time. Take South Korea, which has moved past its unhappy history of financial crises. The country has a rapidly aging population and a large national pension fund, which gives it a deep pool of domestic investors to buy its government debt. As a result, bond yields on its debt don’t vary much and the wind-chill effect is much weaker than for other countries that suffered crises in the 1990s. Countries with a history of financial crises can, it seems, achieve greater resilience than in the past.

Many developing countries still lack deep domestic capital markets, however. In those countries, the central bank is often the largest investor. This arrangement creates a dilemma for policymakers. When the local currency depreciates, import prices rise, driving up inflation. Policymakers would normally raise interest rates to fight inflation, but currency depreciation usually signals a weak domestic economy, which argues for lower rates. In most cases, external conditions win out and central bankers are forced to raise rates to tighten policy.

This dilemma has generated a long-running debate on how authorities should combine sound management of the economy with policies to mitigate risks in the financial system. One common approach is to use tools that lean against the prevailing winds. When domestic borrowing is rising rapidly, for example, policymakers can tighten monetary policy to prevent the boom from getting out of hand.

Another approach could be to build up foreign exchange reserves when investors are pouring capital into emerging markets. Recent research by the Bank for International Settlements suggests that building up reserves cools down the growth of credit by much more than one might expect from the normal mechanical effect whereby bonds sold by the central bank crowd out lending by commercial banks.

The big difficulty with any systematic intervention in the foreign exchange markets is that the government in question will be accused of manipulating its currency to boost its trade competitiveness. Such accusations bite hard, especially given the current political environment. International policymakers should perhaps allow room for governments to intervene temporarily in currency markets in order to slow the appreciation of their currencies but not to fix the exchange rate for long periods. But even here, the practical details will be difficult to thrash out.

When it comes to debt crises, analysts often see building up foreign exchange reserves as a distant second best to creating a global financial safety net, a collection of national and international policies and institutions designed to lower the risk of crises and tackle them when they occur. Analysts often frame the choice as one between costly self-insurance by emerging-market economies and a centralized insurance scheme.

But in practice, the arguments aren’t so clear-cut. The traditional reason for building up foreign exchange reserves during economic upswings is so that they can be used in a crisis. But building them up may also dampen the boom itself and thus make crises less likely in the first place.

Policymakers must recognize the importance of global liquidity for domestic financial conditions. It is all too easy for an economy enjoying abundant credit to mistake the cyclical upswing in investment for a vote of confidence in its domestic economic policy. Governments need to be careful not to drink too much from the fountain of global liquidity during times of plenty.

Most important, developing countries need to build strong economic fundamentals if they are to benefit in a sustainable way from open global capital markets. Solving original sin has turned out to be harder than simply following a recipe of good policies, but the success of some countries in putting their debt crises behind them shows that it can be done.

This article was originally published in Foreign Affairs.