Since the beginning of the year, global markets have experienced sharp volatility across key indices, reflecting a pervasive climate of financial and economic unease. Geopolitical tensions, escalating military risks, and intensifying competition over strategic and precious minerals have contributed to a global environment of uncertainty, while speculation in gold and silver, instability in commodity and energy prices, and fluctuations in the dollar’s exchange rate have compounded the anxieties of policymakers and central bankers alike.

In late January, gold surpassed $5,500 per ounce for the first time, even as the dollar retreated against most major currencies. The greenback later regained some ground, by which time gold had shed part of its gains amid profit-taking. The reversal was influenced in part by the nomination of Kevin Warsh to lead the US Federal Reserve, which fuelled expectations of policy adjustments affecting interest rates and the management of US debt.

The relationship between gold and the dollar remains technically intertwined, noted The Wall Street Journal, generally favouring the precious metal, which is priced in dollars and typically benefits from any weakness in the US currency.

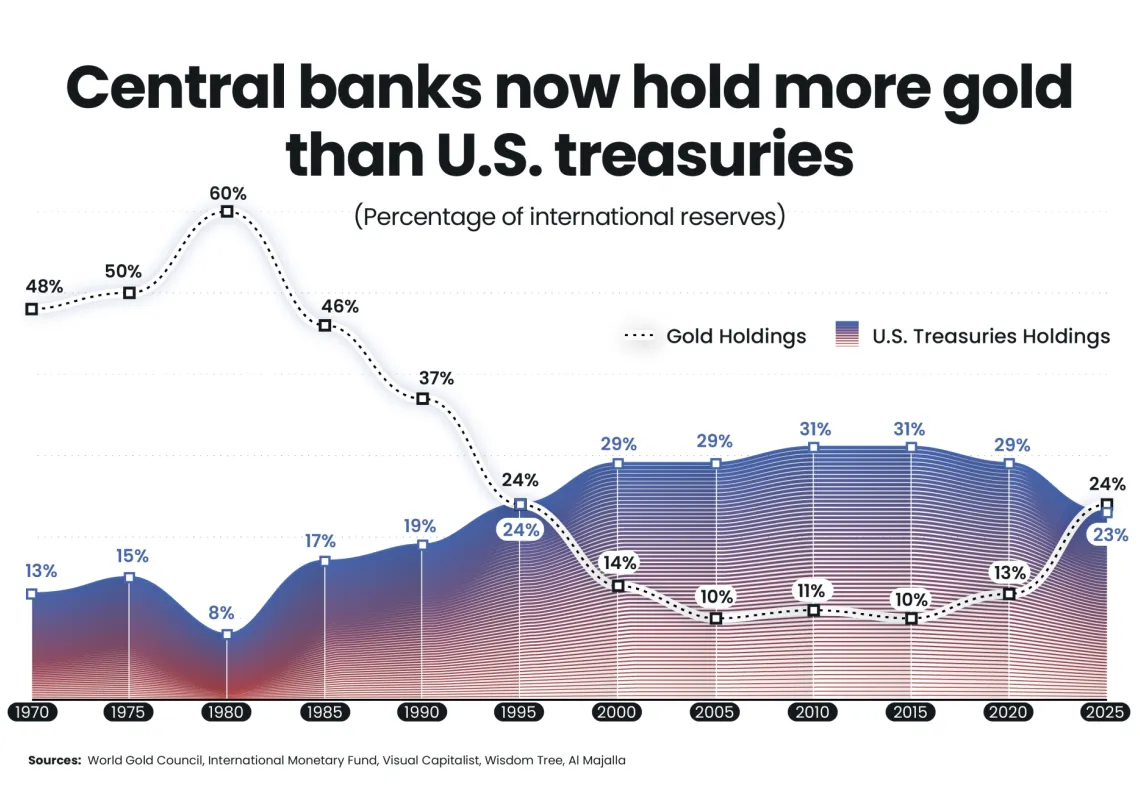

Demand for gold traditionally strengthens in times of crisis. Economic, trade, and financial sanctions have encouraged states to accumulate precious metals as safe havens in anticipation of currency shortages. Gold has risen by more than 60% over the past year and gained 11% in January before retreating by 9% at the beginning of February. Silver also exceeded $110 per ounce last month, reflecting a fervent rush towards precious metals.

An analysis published by India’s Economic Times noted that profit-taking and the dollar’s partial recovery—set against geopolitical and monetary concerns and fears of resurgent inflation—have weighed on markets in recent days. Even so, gold prices remain historically elevated despite the recent pullback. India ranks among the largest gold markets in South Asia and the Near East.

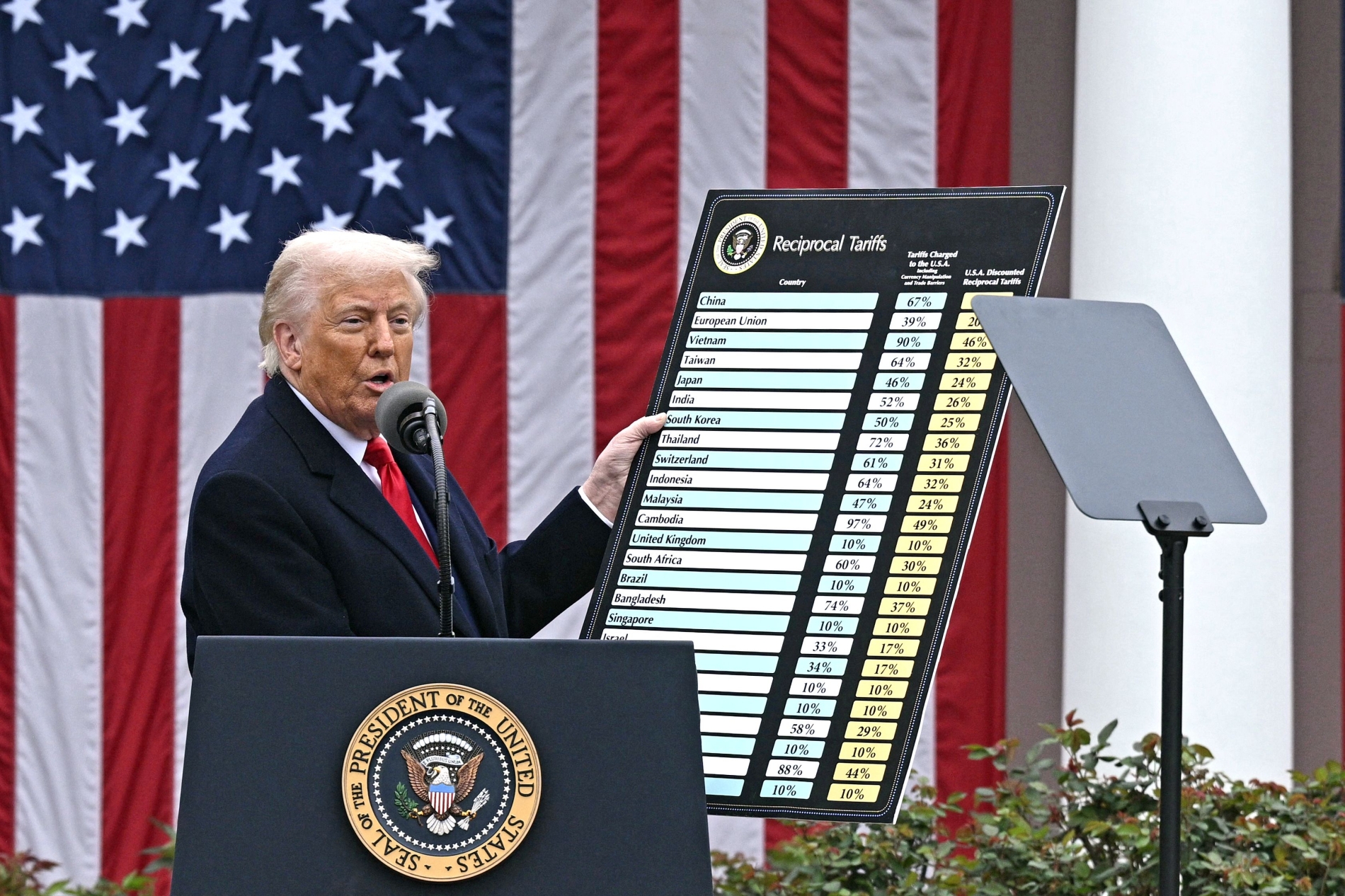

US President Donald Trump recently announced a reduction in tariffs on India from 50% to 18%, stepping back from earlier threats of sanctions linked to New Delhi’s purchases of Russian oil. The move sent a stabilising signal to markets and reinforced demand for the dollar. At present, the US currency appears to derive more support from financial market confidence than from the policy preferences of the US administration, which has indicated a preference for a relatively weaker dollar to boost exports and investment.

Trump wants to attract trillions of dollars in foreign direct investment to the US, particularly from the European Union, the Gulf states, Japan, China, and South Korea. Some analysts question the scale of his projections, suggesting that total inflows may reach $9.5tn during his term, according to the French economic daily Les Echos.