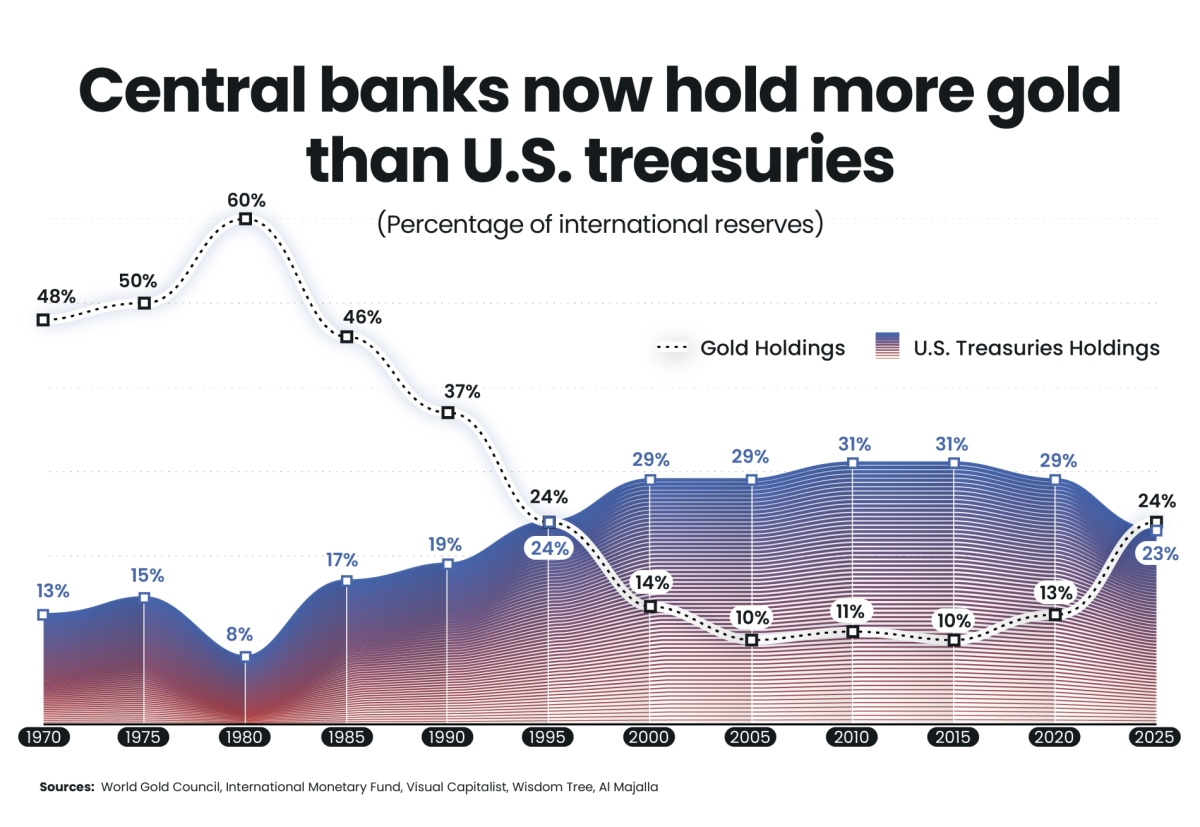

For the first time in nearly three decades, central banks’ combined gold reserves now exceed their US Treasury holdings—a symbolic shift reflecting diversification away from dollar assets.

After the collapse of Bretton Woods, high real interest rates and the petrodollar era made treasuries the cornerstone of global reserves. But since 2022, record official gold purchases—over 1,100 tonnes that year— marked a decisive return to hard assets.

By 2024, gold accounted for about 18% of total reserves, up sharply from the mid-2010s. This surge, driven by geopolitical risk and currency concerns, saw prices surge to $4,000 per ounce in October 2025. The rebalancing demonstrates the preference for durability, neutrality, and store-of-value qualities over yield.

Emerging markets—led by China, Russia, and Türkiye— have spearheaded this trend, positioning gold as a strategic hedge against the vulnerabilities of an increasingly indebted dollar system.