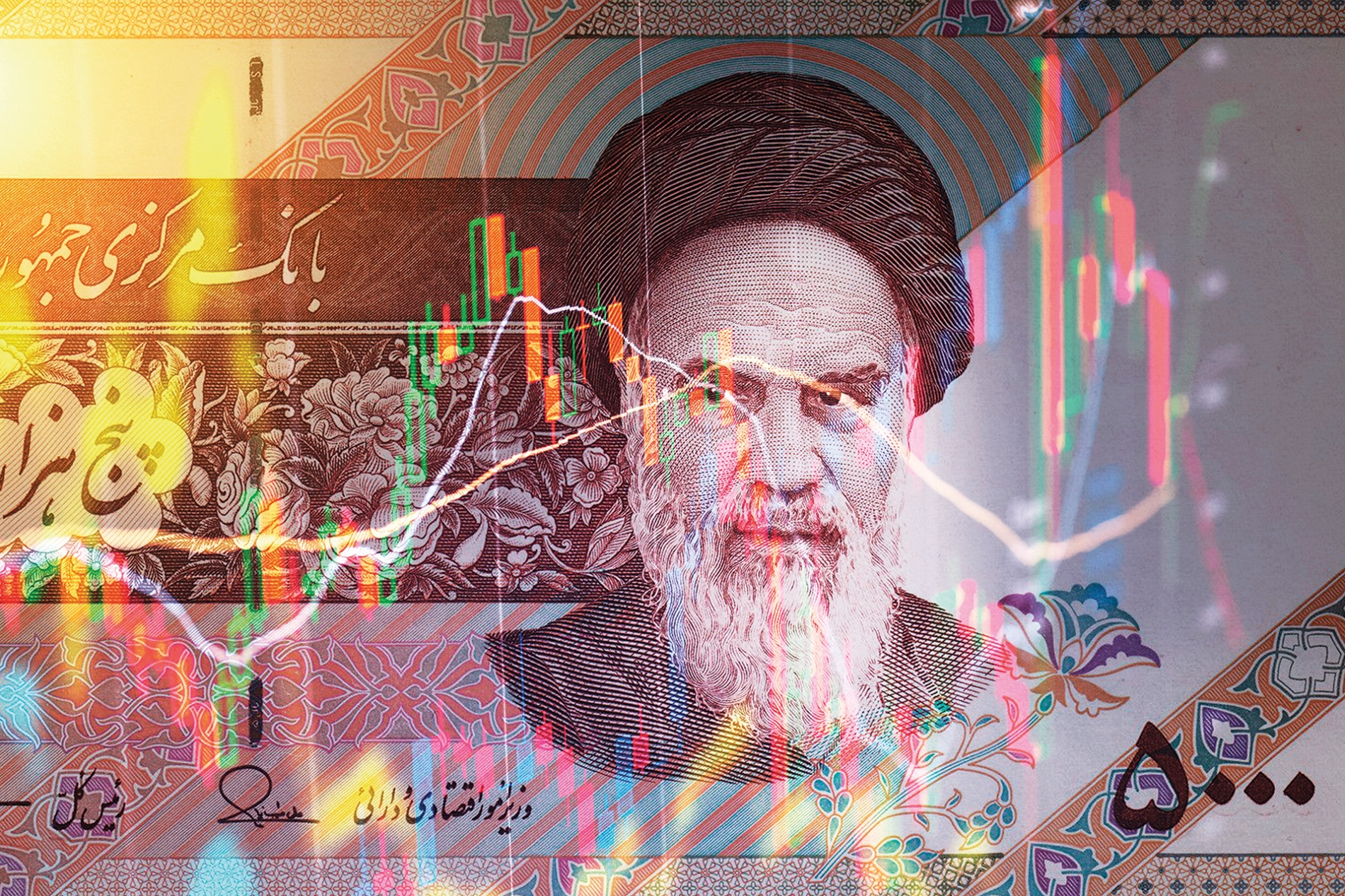

During the 12-day war with Israel in June, Iran’s military and nuclear infrastructure suffered damage that is likely to cost billions of dollars to repair. Now that the guns have fallen silent, how able is it to muster the finances? On a broader level, what is the potential in Iran’s economy, and what are its current capabilities?

The country remains an energy superpower, with an oil industry that traces its beginnings back to 1901, when British businessman and speculator William d’Arcy won a concession to explore, obtain, and market oil, natural gas, asphalt, and ozokerite (a kind of paraffin) in southern Persia.

For almost eight decades, the country enjoyed substantial oil revenues, Iran’s oil production peaking in the 1970s. According to the International Energy Agency, Iranian oil production reached its zenith in 1976 at 6.6 million barrels per day. By 1978, Iran had become the second largest oil producer and exporter in OPEC (the Organisation of Petroleum Exporting Countries), ranking fourth globally in oil production.

Then came 1979

Success lasted until Ruhollah Khomeini’s revolution ousted the Shah in 1979. The devastating Iran-Iraq War soon followed, from September 1980 to August 1988, during which Iranian oil production and exports declined. Ali Khameini became Supreme Leader in 1989 and Iran set about improving its capabilities, eventually pumping out 3.9 million barrels per day (bpd) in 2008.

Yet tension between Iran and the West was never far from the surface and additional sanctions were imposed in 2006 after Iran refused to halt its uranium enrichment programme. These US-led sanctions targeted investments in oil, gas, petrochemicals, exports of refined petroleum products, business dealings with the Islamic Revolutionary Guards Corps (IRGC), banking, shipping, and insurance, to name but a few.