Gold hit an all-time high of $5,100 per ounce in recent days, as investors sought a safe-haven asset and banks forecast a continued rise. Alongside the ascent of gold, silver and platinum also reached record levels. Silver hit $117 per ounce, from a previous high of $43 in 2011.

The flight to precious metals emanates from market jitters over US President Donald Trump’s scattergun tariffs, most recently targeting American ally South Korea. The White House said on Monday that it would raise tariffs on Korean cars, medicines, and lumber from 15% to 25%, accusing Seoul of “not living up to” a trade deal signed with Washington in October. Trump also threatened Canada and several NATO allies.

Anticipating disruption, analysts said there was now “an uncertainty premium” embedded in gold prices. Platinum recently hit a record high of $2,928 per ounce, while palladium climbed about $2,000 per ounce. Platinum’s previous high was in March 2008, at the height of the global financial crash, when it traded at $2,162 per ounce. The previous highest price for silver came in May 2011, when it hit $43 per ounce.

Pricing and forecasts

The price of gold is determined by supply and demand and by investors’ views on where the price may be heading. The gold spot price represents the price paid per troy ounce of gold in unallocated form. Physical gold usually trades at a premium above the spot price to cover costs associated with manufacturing, transportation, and storage.

Washington threatened tariffs of 100% on Canada shortly before Canadian Prime Minister Mark Carney flew to China last week, yet he also threatened tariffs on European allies over his desire for Greenland, a Danish territory. Analysts now think Trump’s aim is to splinter the world order that America helped design 80 years ago, in the aftermath of the Second World War.

The International Monetary Fund recently upgraded its global GDP (gross domestic product) growth expectations for 2026 to 3.3%, noting resilience despite the geopolitical disruptions. The World Bank puts it slightly lower, at 2.6%. Causes for optimism include the strong performance of the US economy (the world’s largest) and record levels of investment in AI and related infrastructure.

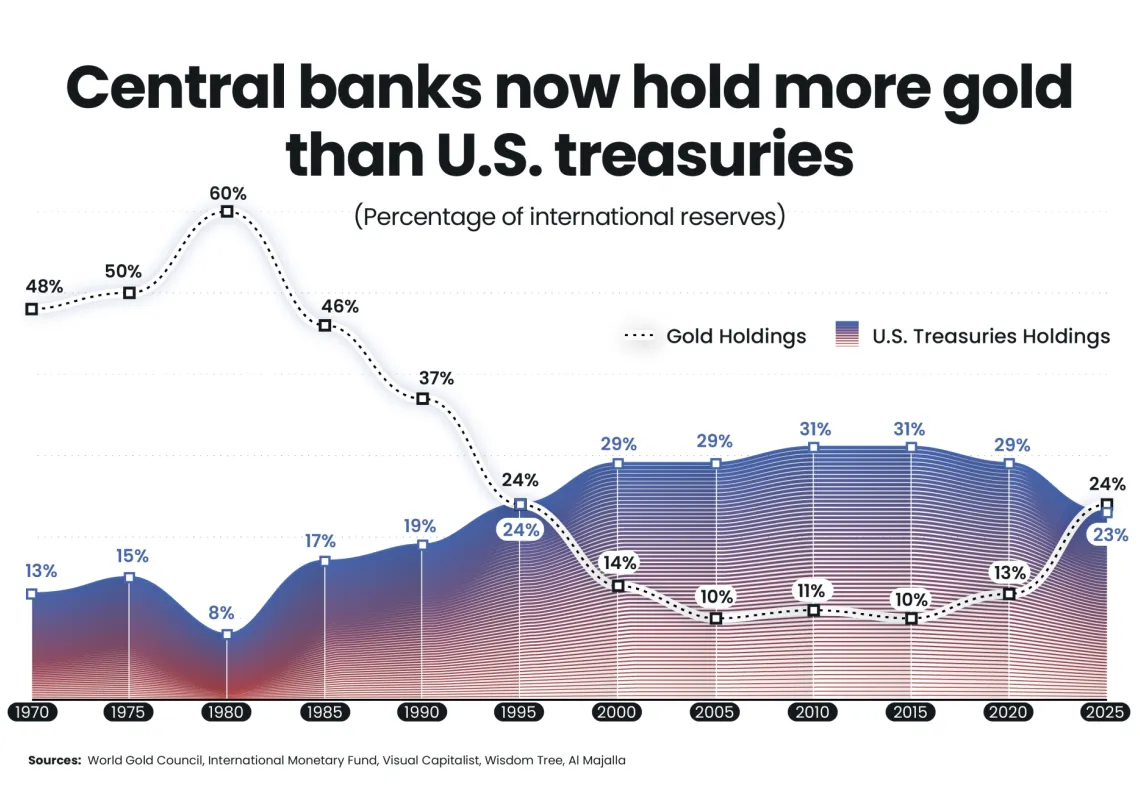

China, a major gold buyer, saw its economy grow by 5% in 2025. Many economists expect that rate to slow to around 4.8% in 2026, but investment bank Goldman Sachs has suggested that 4.8% may be more reasonable, citing surging exports. China’s gold holdings typically increase by around 44 tonnes per year, but gold still accounts for less than 5% of China’s total foreign reserves, which are composed chiefly of the yuan, dollar, euro, pound sterling, Swiss franc and Japanese yen.

In 2020, as the pandemic hit, gold prices approached $2,000 per ounce, where they hovered for the next three years. By the end of 2024, however, they were climbing to around $2,700 per ounce, and by November 2025, they had surged up to $4,000 per ounce. That extraordinary rise, fuelled largely by demand from central banks, has only continued into 2026, its value climbing 8% in just one week in January.