After the total value of digital assets recently exceeded $4tn, there is no doubting the global growth of cryptocurrencies over the past decade. The Middle East and North Africa are no exceptions; yet, across the region, governments' regulations and attitudes towards digital assets still resemble a patchwork quilt, with some welcoming blockchain-based currencies, others banning them, and others remaining passive.

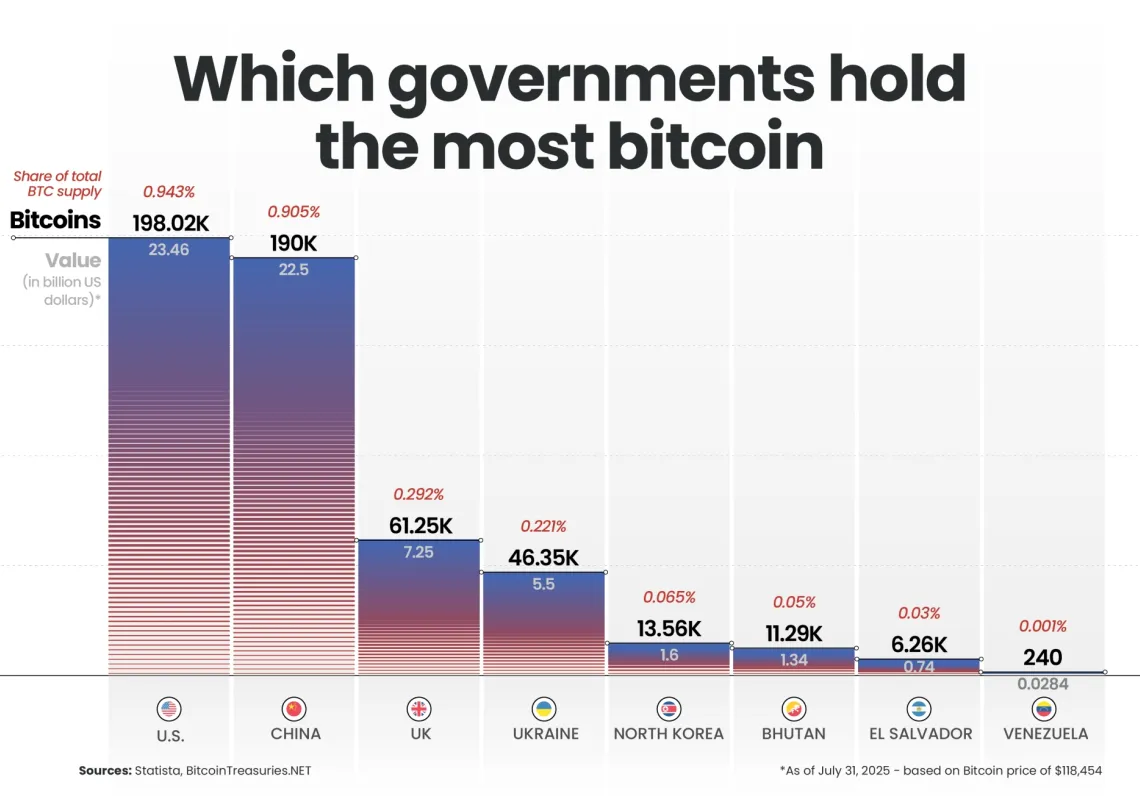

The re-election of Donald Trump for a second White House term beginning in January 2025 gave the crypto industry a boost, given that the US president is a fan. But some countries, such as China, still ban crypto-trading and mining (the energy-intensive operation to produce digital coins). In the Gulf and wider Arab world, there are different approaches, with the United Arab Emirates unquestionably the keenest.

A May 2025 report by Carnegie Endowment for International Peace, titled The Future of Cryptocurrency in the Gulf Co-operation Council Countries, noted that within the Gulf Cooperation Council (GCC), digital finance “is now central to national economic diversification as well as member states’ efforts to reduce their reliance on Western financial systems”.

The report, authored by Harvard researcher Ala’a Kolkaila, notes that the increasing prominence of crypto in the Gulf is being driven by the GCC’s “economic reform, the pursuit of financial sovereignty, and resilience in the face of geopolitical shifts and oil-driven vulnerabilities”.

The GCC trio of the UAE, Saudi Arabia, and Bahrain are keen to pilot a state-backed central bank digital currency (CBDC) to help develop and diversify their economies. Kolkaila said they had an “open but cautious” approach to CBDCs but saw the “potential to reduce US dollar dependency and enhance cross-border payment efficiency,” adding: “Beyond their technical utility, CBDCs are strategic assets in Gulf countries’ broader effort to recalibrate their financial sovereignty.”

Growth of crypto

Born in 2009, when Bitcoin was invented, digital currencies rose to prominence around 2017 when their values soared dramatically, driven by ballooning global demand. In July of this year, the total market value of crypto assets exceeded $4tn for the first time, not far off the GDP (gross domestic product) of Germany, Europe’s largest economy. In 2011, one Bitcoin could be bought for $1. Today, one is worth $120,000.

Trump launched the US Strategic Bitcoin Reserve to establish an account for orderly and strategic management of its digital holdings, and in the Middle East, Israel was once thought to be the natural home of crypto-trading, but Tel Aviv has never been a fan, and this has cleared the way for the UAE to become one of the world’s most attractive crypto-markets.

Authorities there were quick to regulate crypto-trading. Abu Dhabi and Dubai have since drawn interest from crypto heavyweights like Binance, the world’s biggest crypto exchange. Dubai’s emergence as a crypto hub “was driven in part by Russian firms relocating from Geneva to the UAE to circumvent international sanctions” after the invasion of Ukraine in 2022, Kolkaila said.

In March, Abu Dhabi's AI-focused investor MGX bought a minority stake in Binance for $2bn, helping to cement the UAE's position. In January, one of Abu Dhabi's sovereign wealth funds, ADQ, invested in Paris-based crypto wallet technology firm Dfns. The Emirates have also taken steps to launch stablecoins, which are digital tokens usually pegged to traditional currencies, making them less prone to wild price fluctuations.

The UAE's central bank approved the dirham-backed AE Coin in December, and in April, ADQ said it would launch another stablecoin fully regulated by the central bank, together with First Abu Dhabi Bank PJSC and the $240bn investment company IHC. The central bank is also launching the Digital Dirham—a digital alternative to physical money that can be used for transactions.