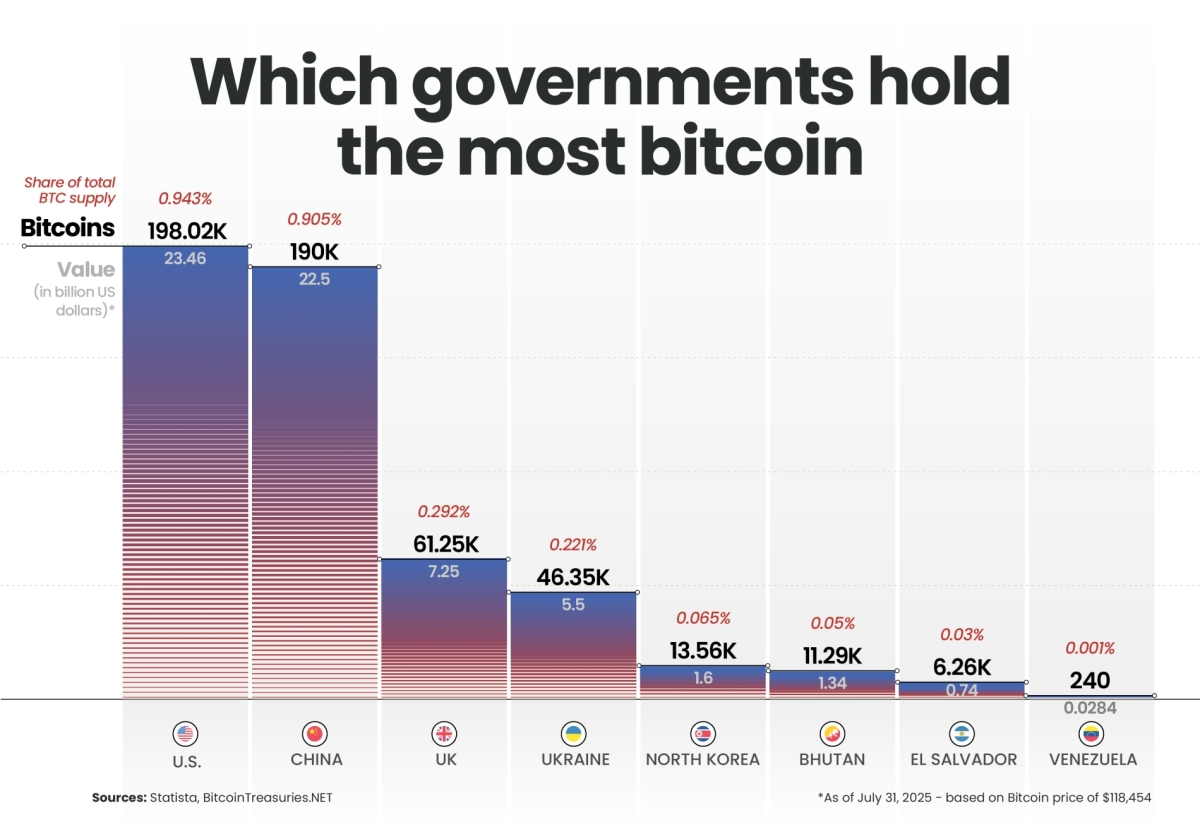

As of 31 July 2025, some of the world’s largest national reserves include hundreds of thousands of bitcoins, valued in the billions of dollars.

The United States and China top the list of government holders. In the US, a significant share of its Bitcoin stockpile comes from law enforcement seizures tied to high-profile cases such as Silk Road and other dark web markets. China, despite outlawing retail crypto trading, has maintained vast reserves, primarily through confiscations linked to fraudulent schemes and mining crackdowns.

Bhutan has also emerged unexpectedly on the scene, amassing over 11,000 BTC through its secretive hydropower-driven mining projects. Meanwhile, El Salvador remains the only country to purchase Bitcoin outright as part of a national financial strategy.

Governments may hold Bitcoin to diversify reserves, hedge against inflation, and gain financial sovereignty and insulation from international sanctions. However, market volatility, lack of regulation, and potential clashes with global institutions make it a risky strategy that could undermine stability and strain international relations.