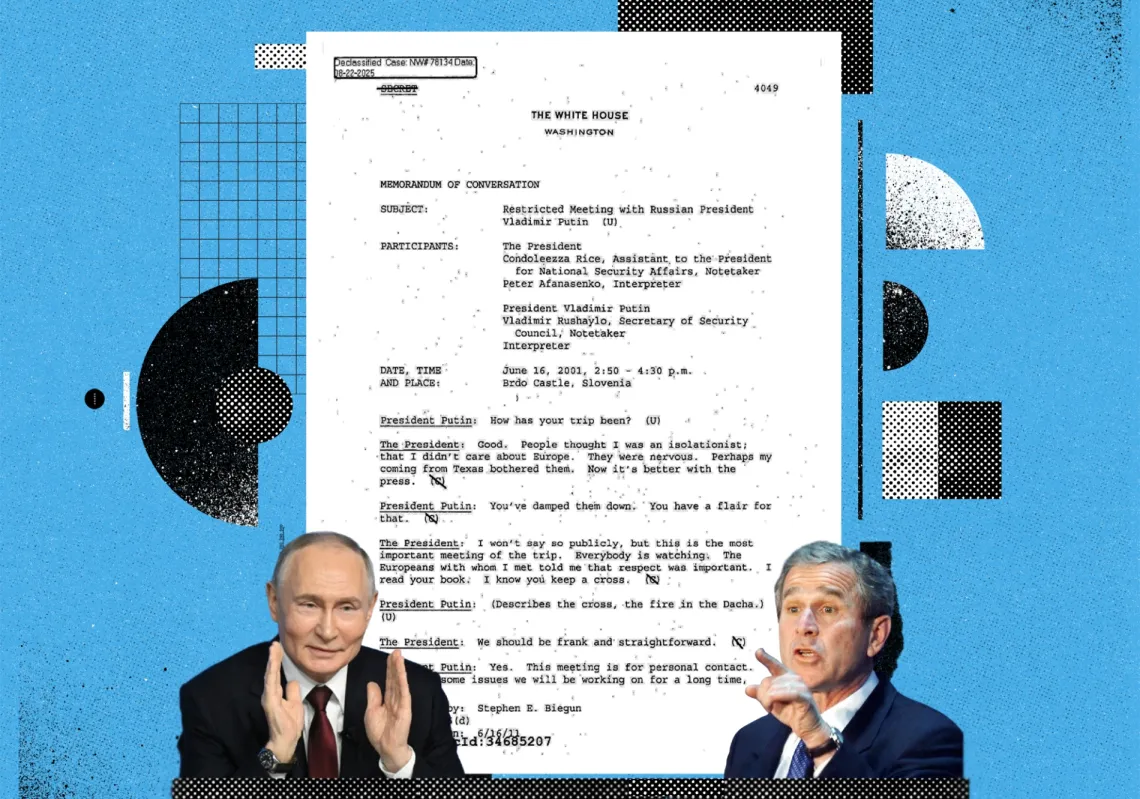

Chinese President Xi Jinping (R) meets with Indian Prime Minister Narendra Modi on September 5, 2017 in Xiamen, Fujian Province of China. (Getty)[/caption]

Chinese President Xi Jinping (R) meets with Indian Prime Minister Narendra Modi on September 5, 2017 in Xiamen, Fujian Province of China. (Getty)[/caption]

by Andrew Small

When Beijing announced its One Belt, One Road initiative five years ago, the global reaction was immediate and pronounced. OBOR, as it became known, was hailed as a transformative effort to deploy China’s economic might in service of its strategic goals. By going out of their way to reject analogies to the United States’ Marshall Plan in Europe, Chinese leaders in fact invited the comparison. Chinese ports, pipelines, roads, and railways would expand commercial, investment, and infrastructure linkages from Asia to Europe. They would build new markets, integrate poorly connected regions, and stabilize the Chinese periphery. Ultimately, they would lay the groundwork for a Sinocentric global order,

No region seemed to make a more promising target for such ambitions than South Asia. Sparsely populated Central Asia is a transit route and energy source rather than a serious market. East Asian trade and infrastructure connections are already well developed. EU public procurement rules preclude a privileged role for Chinese companies. Russia is in economic decline.

South Asia, by contrast, appeared to have all the right ingredients for the Chinese economic model: large populations, fast-growing economies, GDP per capita comparable to China’s a decade earlier, weak connectivity, and major infrastructure deficiencies. When Chinese Premier Li Keqiang undertook his first overseas visit in 2013, South Asia was the location he picked to tout two new economic corridors, a version of OBOR avant la lettre.

But five years on, such hopes have proved unfounded. The region has instead become the main battleground for OBOR’s future—with India as its chief opponent, Pakistan as its chief enthusiast, and, in between, countries from Nepal to the Maldives facing economic choices that have become highly politicized. While the hope may have been that Chinese investment schemes would help mitigate competition in the region, the result so far has been precisely the opposite: OBOR has fused with and reinforced existing divisions. If China wants the economics of the initiative to achieve its intended strategic effects, it will need to square the politics first. South Asia illustrates the obstacles Beijing will face when it fails to do so.

CHINA AND INDIA AT A CROSSROADS

At the crux of this contest is the Sino-Indian relationship, which has deteriorated sharply in the last few years. In other regions, Beijing offered careful reassurances to countries that might try to frustrate Chinese investments in their backyards. With Russia, for example, China noted that OBOR would complement and reinforce Moscow’s own connectivity plans. Beijing made no such efforts with India. New Delhi had been willing to join earlier Chinese-led initiatives, such as the Asia Infrastructure Investment Bank (AIIB), when Chinese diplomacy displayed deftness and a multilateral spirit. China’s conduct around OBOR in South Asia took a clumsier and more unilateral form. Its quasi-official maps of the initiative included Indian ports, despite the lack of any consultations between the two sides. The economic corridor linking Bangladesh, China, India, and Myanmar was likewise folded into the scheme without Indian agreement.

Most controversially, China announced that OBOR would include the China-Pakistan Economic Corridor (CPEC), an investment scheme potentially worth tens of billions of dollars, which India has formally objected to on the grounds that the route passes through disputed territory. In practice, the cross-border aspects of CPEC are modest—some fiber optic cable installations and road upgrades had already been under way—and the projects in the contentious region of Gilgit-Baltistan are similarly small in scale. CPEC is essentially an investment package rather than a serious transit route. But the “corridor” terminology and ambitious claims from the Pakistani side about future railways and pipelines implied a more significant change to the status quo. This only deepened New Delhi’s long-standing anxieties over Sino-Pakistani relations, which have for decades been built around the common security goal of counterbalancing India. While China has sought to portray CPEC as a means to stabilize Pakistan, India sees it as emboldening Karachi.

OBOR’s takeoff in the rest of the region triggered a fresh round of concern about the security risks of China’s growing economic reach. For India, Sri Lanka exemplified its gravest fears. Beginning in 2007, China began supplying arms and diplomatic cover to the government of President Mahinda Rajapaksa, which played a crucial role during the brutal denouement of the country’s civil war. Beijing also lent an already indebted government funds to pursue several vanity projects, which enabled Rajapaksa to woo his political base. Alarm bells went off in New Delhi when China’s People’s Liberation Army (PLA) submarines paid port calls in Colombo without advance notice, the last straw that prompted Indian efforts to bolster the opposition to Rajapaksa in the 2015 election. But the new president, Maithripala Sirisena, who wanted to extricate Sri Lanka from some of the Chinese contracts, quickly found that the terms were inflexible and had left the country with virtually unserviceable levels of debt. China was willing to negotiate but sought a debt-for-equity swap that would give Chinese companies a long lease on Hambantota port.

In spite of this, India has maintained the upper hand politically. The 2015 elections proved that there was a price to be paid by Sri Lanka for ignoring New Delhi’s redlines. With the Hambantota lease deal, the Sri Lankan government carefully assured Indian officials that sensitive port operations, including security management, would be controlled by a Sri Lankan company and that the port would not be used for military purposes. It also denied subsequent requests from the PLA Navy to make port calls in Colombo. New Delhi’s message resonated throughout the region, prompting other governments to provide private reassurances that Chinese investments would not be a prelude to militarization. Beijing may find friendly governments to work with temporarily, but with the exception of Pakistan, it will find it very difficult to establish a dual-use port in South Asia that the PLA Navy can count on.

But Sri Lanka’s case also offered a warning to India of the economic realities working against it. Colombo was forced back to the negotiating table with China for lack of any better options. India has since improved its efforts to offer countries appealing economic alternatives. But its various limitations—in its resources, its capacity for direct investment, its significant infrastructure needs at home—have necessitated partnerships with other concerned countries. The most important of these has been with Japan, which created in 2015 the new “Partnership for Quality Infrastructure,” an expansion of the infrastructure resources provided by the Asian Development Bank (ADB), and in cooperation with India developed an “Asia-Africa Growth Corridor.” Perhaps the most telling Indo-Japanese intervention was in Bangladesh, which in 2015 was in the advanced stages of agreeing to a package of Chinese financing for a new deep-water port. But political pressure and economic incentives (including the largest yen loan that the Japan International Cooperation Agency has ever offered for developmental assistance) pushed Dhaka to opt for a Japanese deal instead.

Almost as important, Sri Lanka handed India a propaganda coup. In Colombo, a convincing story has taken hold, one that paints OBOR as predatory, a debt trap, and a route to military expansionism. In reality, the new Chinese highways have been beneficial; and the expansion of the Colombo port has been an economic success, with the overwhelming majority of the port’s activity consisting of trans-shipment to India. Yet that more nuanced picture is overshadowed by the evocative sight of Mattala Rajapaksa International Airport, a gleaming, fully staffed building with virtually no passengers, no planes, and an empty departures board, surrounded by sweeping highways on which cars are outnumbered by auto rickshaws, cows, and elephant dung. It is that image that has come to embody OBOR in Sri Lanka, much to India’s delight.

A ZERO-SUM FUTURE?

Beyond South Asia, India has been notably effective in influencing the debate over OBOR by consistently raising its concerns at the highest political levels to countries with plenty of reservations of their own. It was no coincidence that in October 2017, fresh off a trip to New Delhi, U.S. Defense Secretary James Mattis testified before the Senate Armed Services Committee about OBOR “going through disputed territory.” India, alongside Japan, has reinforced the Trump administration’s competitive stance toward China and encouraged the adoption of a “free and open Indo-Pacific” strategy that is partly intended as a counterpoint to OBOR. When the newly resumed security “quad” (Australia, India, Japan, and the United States) met in November 2017, these strategic economic issues took up much of the agenda.

Clearly, none of these developments will stop China’s economic advances in South Asia. There are over $20 billion worth of projects moving ahead on the ground in Pakistan. The Southern Expressway in Sri Lanka is progressing ineluctably to connect Hambantota and Colombo. China has just ended India’s Internet monopoly in Nepal. And states elsewhere in the region will continue to take advantage of China’s growing role to gain leverage in their dealings with New Delhi, the traditionally dominant power in their neighborhood. But alongside its partners, India does place certain limits on OBOR in the region by creating an environment in which it is politically costly to pursue various projects without taking Indian interests into account. This puts OBOR at a crossroads in the region.

There are three potential scenarios for what could happen next.

Beijing could make a unilateral course correction, opting to have a greater portion of its efforts in South Asia look more like those of the AIIB: more transparency, less onerous loan terms, a closer partnership with multilateral institutions, and more focus on regional connectivity than bilateral links to China. Beijing is not going to turn the whole of OBOR into the AIIB—it wants to preserve its prerogatives to pursue politically targeted projects with narrower bilateral benefits—but a shift would reduce the levels of criticism and opposition.

China and India could also reach an informal agreement over the scope of OBOR, given that there is still considerable room for negotiation, even over Indian sensitivities about CPEC. Particularly if China made progress on other thorny issues, such as on India’s membership in the Nuclear Suppliers Group, New Delhi’s stance on OBOR could end up resembling Japan’s: retaining economically competitive elements while identifying targeted areas for cooperation. As former Indian National Security Adviser Shivshankar Menon has argued, India’s interest is in seeing more projects like Colombo port and fewer projects like Hambantota. If India more actively engaged China on the rules of the road, its capacity to shape OBOR would arguably be greater.

The most likely scenario is that the competition continues and hardens. Dynamics in South Asia are increasingly taking on a zero-sum quality. And with improving U.S.-Indian and Chinese-Pakistani relations set against a decline in U.S.-Pakistani and Chinese-Indian relations, such dynamics are becoming mutually reinforcing. This is an unhealthy trend, given the pressing need for a better economically integrated region. The connectivity deficit in South Asia remains significant: the World Bank estimates that intraregional trade accounts for only five percent of the total, compared with 25 percent in Southeast Asia, 35 percent in East Asia, and 60 percent in Europe, while intraregional investment stands below one percent overall. Although in East Asia, rivals have been able to sustain mutually beneficial economic relationships, in South Asia, security rifts have stymied trade and investment. Outside parties, including the United States and China, still have an interest in alleviating this problem rather than allowing the economics of the region to turn into an extension of political and military rivalries. The window for doing so is now closing.

So far, OBOR’s rollout in South Asia demonstrates the barriers Beijing will face unless it makes adjustments. Beijing pushed the narrative that growing Chinese trade and investment would spur development, stability, and a more integrated region. But the project’s early promise has been soured by China’s failure to reach a consensus with the region’s major power and to answer serious questions about whether its handling of Sri Lanka is sui generis or symptomatic of its general approach. Even in sympathetic Pakistan, similar concerns are quietly expressed, and the Maldives is shaping up to be the regional test case for 2018. There is still an opportunity for Beijing to push forward a version of OBOR that is likely to command broader support and consent, including from competitors and rivals that can still see benefits in certain Chinese investments. But token efforts, such as recent offers to rename CPEC, are not enough. If Beijing wants a clearer run to advance the economic and strategic goals that underpin OBOR, it needs to do its political homework first.

This article was originally published on ForeignAffairs.com.